Insufficient credit history means what? Here’s How to improve credit history?

Introduction

You must have experienced an insufficient credit history at one time and find it challenging to recover. Here’s the good news. This article covers several procedures to improve your insufficient credit history. At the same time, you know how to improve credit history, particularly with an insufficient credit history.

Before I suggest the four best options to improve credit history; let’s define credit history.

Define Credit History?

Credit History is simply a narration of a credit user’s capacity or resourcefulness to pay back money borrowed from a creditor, also backed up with previous debts paid in full at the right time.

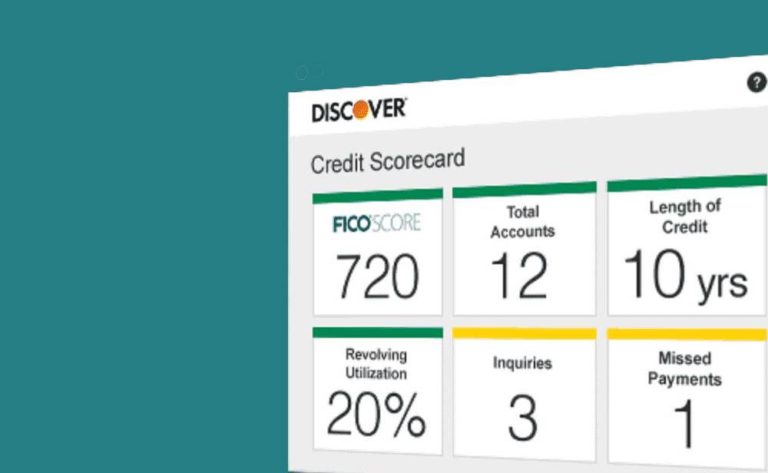

The history comprises data as follows;

- The duration of the account

- Account types

- A list of past credit pulls

- Numbers of accounts created

- Debts amount

- If the user makes timely payments

- Credit utilization.

Insufficient credit history means what?

Insufficient credit history means a credit user is yet to have a good and verifiable performance record with moneylenders or credit companies that approve loans.

Also, it indicates that your current data collated is not sufficient to assign you a credit score.

Before creditors provide a credit card or loan to consumers, they try to have their credit report.

Likewise, someone with an “insufficient” credit report suggests that they are yet to take out a loan for the past seven years. Also, there are no documents to which they can keep track of to show you are reliable enough to borrow money. Having known what Insufficient credit history means, let’s proceed further on how to improve insufficient credit history.

Confirm with the creditors that the personal details sections in your credit report are accurate. In some cases, your credit may mistakenly appear insufficient, upon which moneylenders make mistakes with your data.

Consult and inquire about your utility services for assistance. Try to persuade your telephone networks or Electricity operation to disclose your prompt payment activities to the bureaus.

It’s a cool opportunity to build a credit history quickly.

Request a secured credit card. Your effort to pay your bills at the right time using secured credit cards is not in vain. The authorities in charge of the cards disclose the user’s activities to the credit reporting agencies. This way, it supports building credit.

Get a small loan. Though small loan size has risks; as a result, it comes with high interests. As the case may be, when you pay your bills promptly with this loan, it’s also disclosed to the credit reporting agencies.

This article discusses the four procedures itemized above and other facts you should know relating to insufficient credit.

How to improve insufficient credit history?

Now to the options properly;

1. Confirm with the creditors that the personal details sections in your credit report are accurate

Probably, the credit can appear “insufficient” because of a misspelled word or typographical error in your data.

Any of these corporations, insurance firms, financial institutions, including some other creditors, may have just one of your details mistaken, such as your location, SSN, name (a wrong spelling), and birth date.

For that reason, you had better place a call to the creditors to reassure yourself that your personal information with them is accurate.

Note this: each time you request any credit samples, be in no doubt that your address and name don’t change. Frequently manipulating different personal details while taking out a loan gives a warning to creditors so they can beware of dealing with you.

2. Consult and inquire about your utility services for assistance

Many people see paying monthly bills, for instance, electricity, gas, oil, and telephone expenses, are inconsiderate. The discouraging side is that payers are not commended for their effort to fulfill paying the bills monthly.

In most cases, even though a user has a good banking record, this category of utility services fails to tell the credit reporting agencies about the payment activities. That being the case, you benefit nothing.

However, if it happens, they tell the bureaus? The payment records should significantly support establishing a positive credit score (provided that you make timely payments)

Anyway, what’s the way out? Pick up your telephone, and then inquire about the utility services whether they’d like to provide an account of your prompt payments to the bureaus. It deducts nothing from you when you ask; in fact, you have a good opportunity for your request to be granted. Even though it’s not all, a few of them should support it.

3. Register a secured credit card

Suppose you’re looking for a simple procedure to build credit and use your funds. In that case, you could consider using Secured credit cards.

The system of secure credit cards is generally a PAYG card: a user deposits a specific amount of cash on the credit card. Then use the money and pay the monthly bills in full and at the right time. Subsequently, the banking records observed are disclosed to the credit reporting agencies, which can cause an increase in your credit score before you know it.

However, with secured credit cards, duly note that the interests can sometimes go up; therefore, you have to be clever when using secured credit cards.

4. Get a small loan

Though this small loan option can be somewhat deceiving, likewise, with insufficient credit reports, you can notice a couple of creditors. For instance, LendUp, whose customers have the privilege of such loans, also overlooks credit users with very low scores.

Once you settle the bills when expected, as you’d want it, the service responsible for the mini-loan duly narrates it to the credit reporting agencies.

I need to view my credit history now

Read here to know where you can get your credit report

Drawbacks?

As the case may be, when you’re with no credit score, chances are you give back increased interests for the loan.

By way of illustration, assuming you borrow up to $200, you need to pay interest of $35; also, you should return the loan in two weeks.

Don’t forget. See that it’s something you can settle the bills just before you start to default the required amount to pay every month.

Repercussion from no Credit history

If truth be told, it isn’t easy when you don’t have a credit report. Why so?

Prevented from taking out a loan

A blank or no credit report suggests that getting a loan is very slim. Perhaps you are fortunate to get one; you’d pay higher interests.

You’re flagged as a defaulting borrower

Whenever you request a home, car loan, or others, you need to show reliability and trustworthiness. And that you can establish from your previous credit habits.

When you have no credit report, moneylenders feel uncertain of your chances to pay back a loan on time, likewise whether you’re likely to default.

Bad credit report vs. a blank credit history. Any difference?

Which is more miserably: is it when you have a bad credit report or a blank credit report.

In the real sense, the gap between both is not near:

Suppose you request insurance, credit cards, or loans. In that case, a bad credit report directly tells you you’re not eligible, a sure way for rejection. With poor credit, ordinarily, paying temporarily for accommodation is hard.

Moreover, with the case of no credit: there’s an opportunity. In short, that’s Getting credit no credit history.

For the youths, including those fresh to life affairs, the chances for banks to approve a credit card are pretty high. The reason is that they have the understanding they’re just starting life.

Paying off your monthly bills at the right time can look like a prank.

Meanwhile, when you pay the full amount; also when expected, before you know it, you can build up your credit score with time. It doesn’t end there; you qualify for more financial rewards like requesting more loans or paying temporarily for the use of accommodation, including bigger credit cards.

How fast can I improve insufficient credit history?

Within just 1 – 6 months, you should be able to recover insufficient credit history.

However, it would help if you were very regular in making timely payments to establish more reports needed to provide you with a positive credit score.

Therefore, kindly wait and be responsive to the bill payments; in that manner, your credit report can build after some time.

Sincerely, it requires reliance and endurance. Likewise, you have a chance to prove your resourcefulness to make timely payments. When you demonstrate, you’re current with your payments. You better your options to secure a positive credit score and good history deserving positive credit reports.

Control your debt with credit cards as low as possible; don’t use alternative cards to settle bills or loans on a particular credit card.

How possible is acquiring a credit card no credit history?

Your effort to acquire a credit card without a credit report is somewhat difficult to know, which resulted in the other. Meanwhile, a credit report is important before you can be approved for a credit card. However, you should secure a card to establish a credit report.

Well, there are five choices to make; Check below;

- Use another person’s credit temporarily

- Be an approved user

- Get a loan from your own money

- Register a secured credit card

- Register a store card

Tap on the link below to study further on how to build credit without credit,” read the tips on:

The Best way Rebuild Credit easily? (5 Simple Procedures)

Final thoughts

In building credit, you may see something annoying. Moreover, your “insufficient credit history” refrains you from taking out a loan.

If you can be constant, willing to take the risk, and thoughtful steps, you will likely have your prompt payments disclosed to the credit reporting agencies. This way, you can establish your score.