What’s the best way to check your credit score for free and Quicker?

Introduction

Before you go about the procedures of credit repair and fixing up a good report, know what’s the best way to check your credit score without paying a fee. Check out the following preambles to consider first.

Be accurate checking your actual credit score, do not guess.

Sure, you may perceive the above task as simple as ABC; however, many individuals are totally strange to check their credit score.

Moreover, in a situation where you’re clueless about your credit score and even can’t say anything about it. You’d find it difficult to understand fundamentals with boosting your credit score.

There’s no magic there. Can you check your credit score yourself? Read further to know what’s the best way to check your credit score for free?

In this post, you’d know tips to see your credit score using Discover’s Credit report without paying a fee.

We have a lot to discuss.

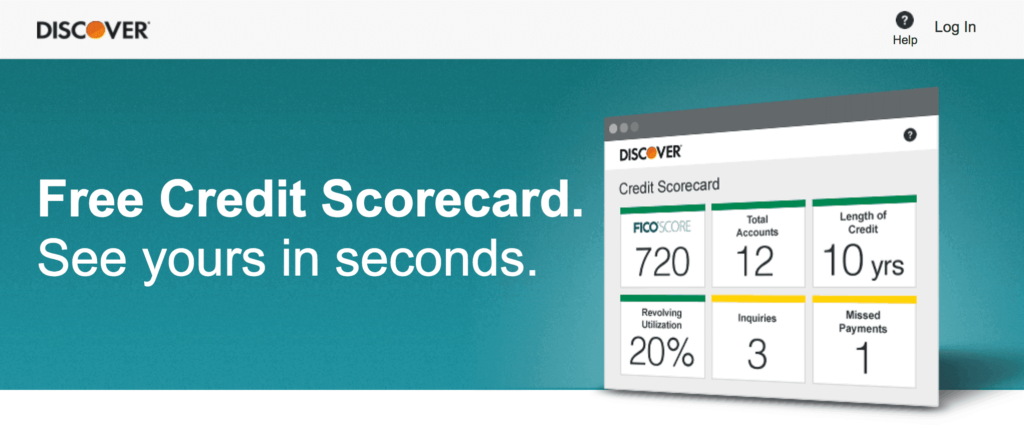

Use the Discover Credit report to determine your FICO® score without paying a fee

Aside from using Discover’s Credit report, you can find several methods to access a credit score. Nevertheless, we like the Discover’s Credit report that Discover company brings on board to anybody who decides to register with the platform without paying a fee.

Immediately you subscribe to Discover and set up an account with the site. You’d be able to access the recent FICO® score, a slide of your record, and a couple of money management services to boost your credit score.

It sounds good to be true; moreover, could there be any obstacles within?

The truth is there is none, but I’m sure you’d find this unbelievable.

Discover did not just start to operate; the firm offered credit score checks to customers way back in 2013. In 2016, the management resolved to allow all individuals free access to the service, making the firm the No.1 main credit card. Also, permit everyone freedom to check credit score with their credit outline.

As reported by the superintendent at Discover, named “Roger Hochschild.” Discover made provisions for the assistance because they “feel it’s necessary customers have an idea what they should do to handle their credit efficiently.” Also, the firm plans to manipulate a means with which “users including non-users as well” can check their credit at their fingertips; as easy as ABC.”

Also, one more inspiring point is that a non-user of the platform can register for Discover Scorecard without being a member of the Discover service.

You should pay attention to the major aspect: handing over your data to confirm your name and other details; likewise, see your credit score.

Five simple steps to sign-up a profile using Discover Scorecard

At this segment, we’d guide you carefully through the process one after the other on using Discover Scorecard to retrieve credit scores.

What’s the best way to check your credit score; Using the Discover Scorecard feature

Let’s start with the procedures to access FICO® score for free.

Procedure 1. Proceed to the sign-up page for Discover Scorecard

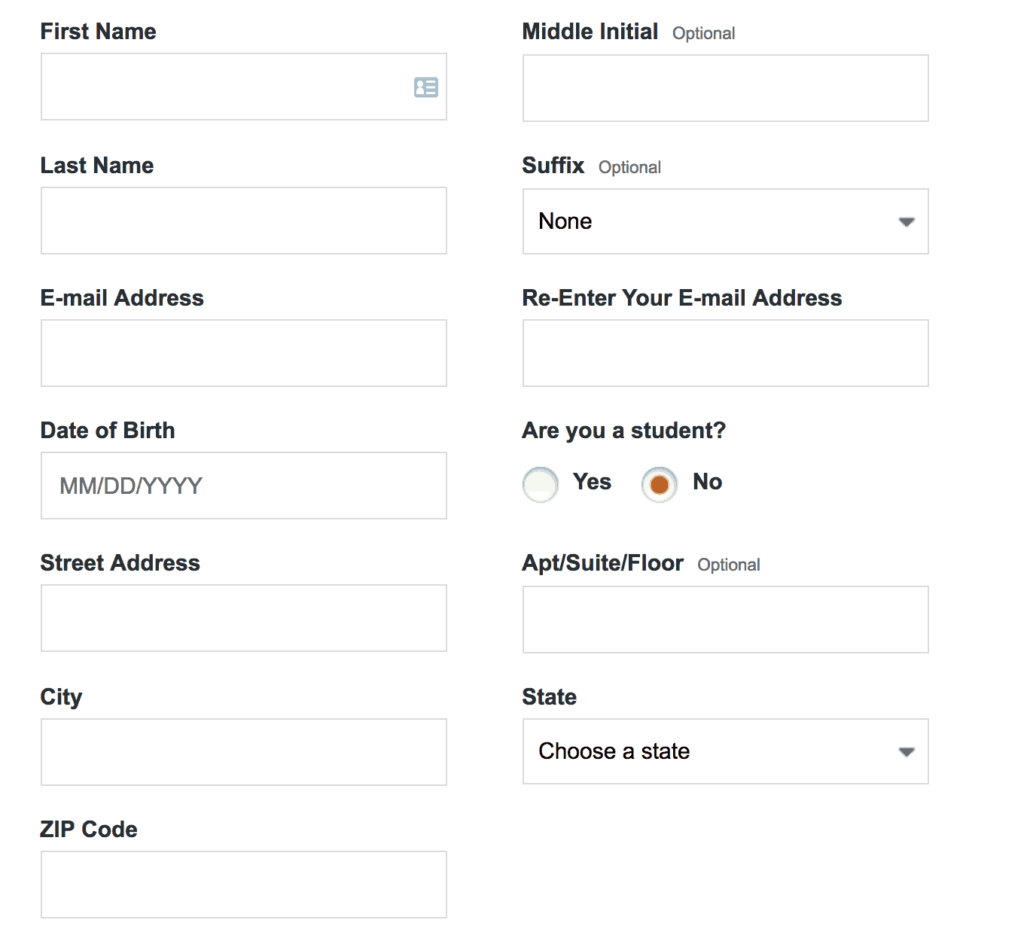

Check out this link directed to the sign-up page. also, the description below is how the page appears to be:

Procedure 2. Complete the required personal details in the blanks

Move the screen vertically down a bit; then the system prompts you to complete one or two personal data to validate the basic information’s provided earlier.

Procedure 3. Accept the terms & conditions, then authenticate your personal information

While you toggle the commands here, the system seeks your consent to say yes to the terms and conditions. After that, you must reply to certain questions to authenticate your personal information, such as age, the former address you once reside in, etc.

Procedure 4. Complete the security questions & answers

After agreeing to the terms and conditions, you must complete the short questions and answers on security use. Once that’s completed, you are good to go!

Procedure 5. Check your Credit score for free

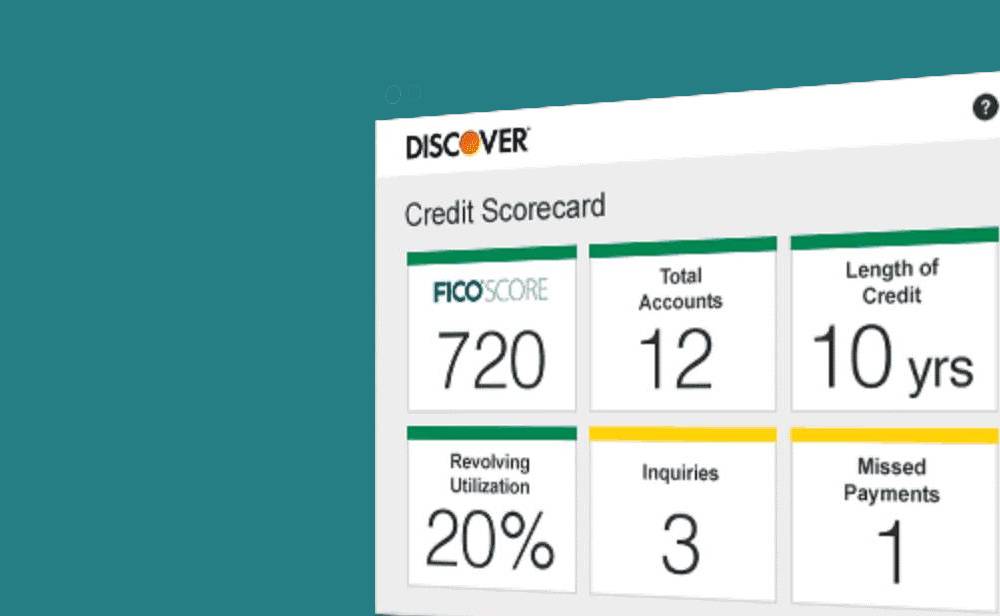

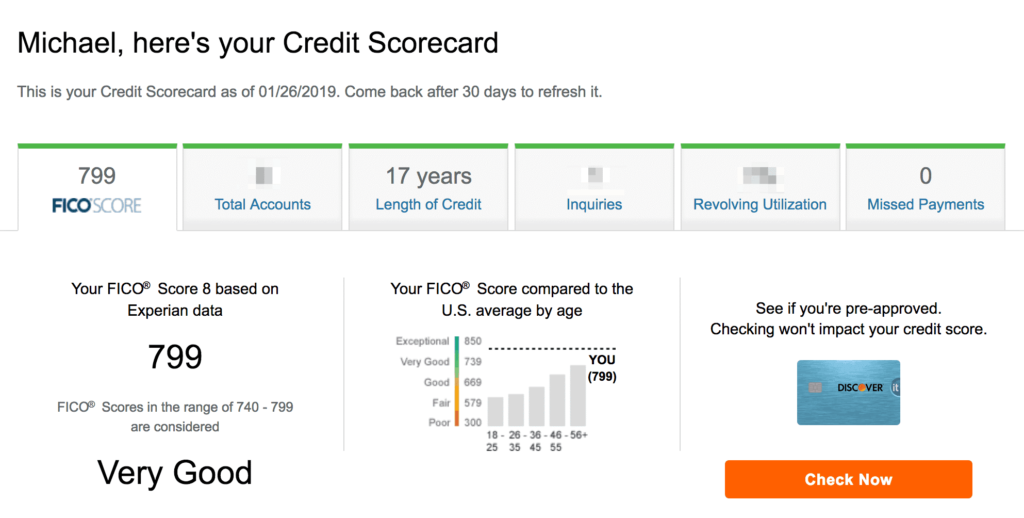

At this stage, you should be able to see your Credit Score, which also details the FICO® score.

Below is a typical example of what you’d see:

Besides, you may tap all the tags across the upper part of the record to access other data.

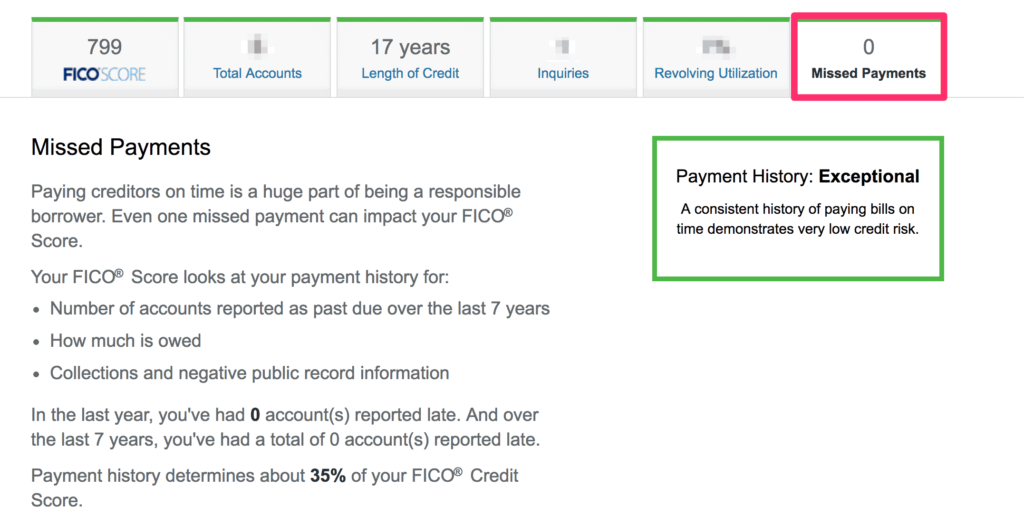

An instance of a personal experience, While I tap the “Missed Payments” tag, below is a description of what’s seen on display;

The Scorecard features?

Remember that the information Discover employs for its Scorecard is contributed from Experian. Experian is among the three major credit bureaus.

Upon that, the website lading page gets down to basics to see how creditors check your credit score.

What’s the best way to check your credit score, Pay attention!

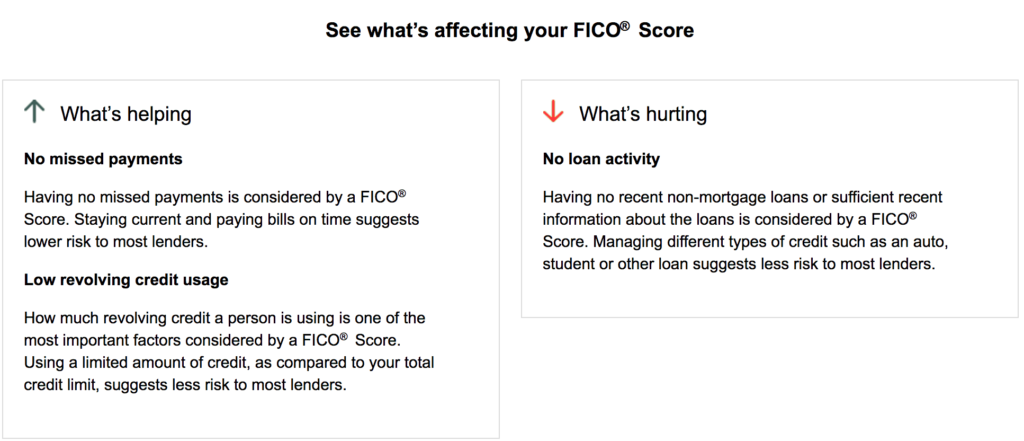

The report lets you know if your credit is low, medium, high, or super-high. At the same time, it thus itemizes the features that impact your score, the age of credit, missed payments, overall account sum, inquiries, and credit utilization.

From the sample presented earlier, the FICO® score at the moment is 799, that’s “very good.” Certainly, it should make room for valuable interest rates for any creditors here.

All the same, though the score is not bad, you can still boost it as the FICO® limits increase up to 850!

What are possible contributions to boost my score?

By that example, the Discover account reports that when you don’t have any “loan request”—car loans or student loans—it negatively affects the credit score.

Author’s message: I would rather respond to how ignorant it is doing without an auto or educational loan negatively affecting the score?

Moreover, that is how you apply Discover account to inquire about your actual credit score by Experian within 5 minutes. It can’t be that very simple.

As it happens, you don’t have to be bothered by the pulls hurting the credit.

Discover solely deals with a soft inquiry to retrieve your information; therefore, nothing like errors on the record.

The meaning of FICO® score?

Fair Isaac Corporation is the pioneer of the FICO® score. The logic with this score is a means to maneuver information from the credit history to work out and determine a user’s self-sufficiency to pay all debts. That is, having sufficient money to pay bills.

Specifically, one of the reasons that the score is important is that lenders can find out the possibility with which a customer could pay their debts when expected.

FICO® score is essential as any creditor checks, and pay attention to it before borrowing your money. But if the score is poor, the creditor is likely to deny you loans or rather ask to pay back with increased interest.

Many creditors specify a standard score that decides if anyone is eligible to offer credit. However, others use the score and some factors to make conclusions.

The FICO® score falls within 300-850, while the mean score is approximate 700.

Mostly, as a person’s credit increases, the more possible they should have access to more credit limits.

FICO® Scoring models

FICO® scoring models are diverse; meanwhile, the very important range is FICO® Score 8. And, it details as follows;

| Poor | Fair | Good | Very Good | Excellent | |

| FICO® Score 8 | 300 – 579 | 580 -669 | 670 – 739 | 740 – 799 | 800 – 850 |

Most creditor decides if they are to grant your loan request with the use of FICO® score.

Most of the time, nothing stops you from having a loan when the score is not good enough.

A few loans like car loans are not as complicated to receive. Moreover, tread with caution: such loans often have a very high interest.

The next line of action!

At this point, your question “What’s the best way to check your credit score,” is addressed. You can now determine your credit score; what should come to your mind after is knowing the factors that contribute to determining the credit score. Read “Know five factors impacting credit score.”

Tap the link above to see the factors that amount to a credit score. Also, with their respective weight on the score in order of importance.