The Best way Rebuild Credit easily? (5 Simple Procedures)

Introduction

You already took the necessary steps to make good previous flaws with your credit, Thumbs up! That’s brilliant of you. Find here the Best way rebuild Credit easily.

Now you’re doing your best to rehab your credit. To eventually have “good credit” contributed to your reputation, you should employ one or two strategic ideas.

In this post, we tabled five Best way Rebuild Credit easily in that way:

- Use temporarily another customer’s credit

- Be an entrusted user

- Register a Retail card

- Take out a loan from your account

- Sign-up for a secured credit card

Your responsibility to rebuild credit is not a process that completes in an instant nor magic you can’t explain; it’s an exercise lasting an extended period.

Moreover, it’s a crucial aspect of the procedures that can eventually bring about a positive change to a customer’s credit record for the better. For this reason, let’s get started with the Best way Rebuild Credit.

Best way Rebuild Credit easily

1. Use temporarily another customer’s credit

Look around and connect with your pals or family members with good credit, seek their permission to countersign, and vouch on your behalf. Also, they should add your name. This particular Best way rebuild Credit procedure is reliable for optimal results.

In most cases, that’s the best way to make a start; you could benefit from a favorable interest rate. Not just that, you are eligible to put in an application for auto loans, private or special loans, along with a couple of credit cards with signatories.

In addition, provided that you pay your bills at the right time, you won’t worry about the collection agency likewise any of your family relations.

2. Urge anyone to join you on their credit card

For instance, another customer listed you as his “entrusted user” to use their card. As a result, you share the same advantage he exploits with the credit card and profit from his principles.

Either your father, mother, or partners may feel like enlisting you as their “entrusted user” to assist with repairing your credit.

And in this case, they permit you to benefit from their card as the case may be, though it can’t be very quickly.

You need to ensure that anyone who is helping you with his positive credit temporarily. Try to get in touch with their issuing firm to confirm whether they communicate the affairs of the entrusted user to the agency. As you should know, you’re to manage the card appropriately.

Your aim for borrowing a friend’s good credit is to improve your credit score and don’t return him to a lower standard.

3. Best way Rebuild Credit: Register a Retail credit card

Further on the best way rebuild Credit, an easy approach to be granted access to high credit limits is Retail credit cards. Signing up for a retail credit card should improve your credit rating. All these promises are possible if you pay your bills when expected and are cautious not to reach the upper limit or pile up large debts.

The Retail credit card increases your balance, then multiplies your credit utilization percentage. That’s something pleasant to hear. The cards offer several juicy rewards, such as paying zero to ship it, a retail price slash, and more premier gifts.

As impressive as the benefits appear, don’t forget retail cards have issues also. Check as follows;

- Most of the time, the Interest rates for retail credit cards are significantly higher when compared to the usual credit cards.

- Retail credit cards are limited because you can only take advantage of the cards at just a single retail outlet. Therefore, don’t miss out!

- The retail credit cards contribute to a credit report as a hard pull, and it’s likely to bring down your credit score by 1-5 points.

- Comparing the Account limits of usual credit cards to retail credit cards are often very high. In other words, that of retail credit cards is lower.

A professional in credit affairs named “Scott Henderson” cautioned;

“A mere 10% price break you want to take advantage of with a retail credit shouldn’t be your number-one reason to register for the credit card.

Better still, let’s assume you were able to discipline yourself to low debts. Also, you make payments monthly; the retail credit card is a great option to consider for Best way rebuild Credit.

4. Take out a loan from your account

Are your earnings reliable? If yes, it’s okay to show you can pay back the loan on time. If you wish, you may think about opting for a “credit builder loan.” The loan helps such that it has no credit stipulations made compulsory for beneficiaries.

I need a credit builder loan; which company has it to offer?

One reliable contributor you can consult on the Net is Self Lender, or go for a neighborhood credit union around your territory.

You could request a loan if the firm agrees to the release of the loan. On request, you can have the loan amount saved in a bank account with your creditor, which serves as collateral. You can’t get the collateral back only when you make a complete payment.

The creditor, similarly, communicates your credit affairs to the three major credit reporting agencies. Peradventure, you can pay bills when expected; you could have your credit score increased considerably.

If you cannot pay your bills quickly, such a loan sample will negatively affect you instead of assist. Therefore, mind that you only borrow loans you could conveniently repay at the right time.

5. Sign-up for a secured credit card

One more way to rehab a credit report is using secured credit cards to rebuild credit. The card does as the title relates. After which you have access to a secured credit card, you have to deposit money to your account of a stipulated amount. Then use it up by buyings processed with the card.

Many secured cards begin in the $300 range. However, a few enable users to deposit any amount of their choice at the early stages.

After that, the creditor reports your banking record to the credit reporting agency and builds your credit report faster.

Following 12 months or thereabouts, you kept paying your bills promptly; many secured card businesses convert the accounts to the regular unsecured credit cards. So you’d have your deposit in return. Though, it comes with a small interest rate at times.

Security credit cards for Best way rebuild Credit is unfailing to adopt for credit related concerns.

For secured credit cards to rebuild credit, charges and interests are high; as a result, investigate to ascertain you have the most favorable bargains. Keep that to memory!

When applying Best way rebuild Credit, prevent the following errors

If it’s your first time getting started, at your discretion, you can use any credit-building instructions you could think of at the same time. Moreover, you’re likely to hurt your credit; any slightest mistake can entirely cause another problem.

Are you in need of assistance to improve your credit or Best way rebuild Credit? A credit repair business should find a way out. Follow our tips to select the best credit repair business.

Be bold to make a move and repair your credit; prevent these simple mistakes as much as possible.

Payments made but unaccounted for

By now, you should know the value attached to paying your bills at the right time in your credit affairs. Merely a single late payment or that which is unaccounted for can affect your credit score considerably.

While doing your best to repair credit and experience inadequacies to moderate the poor credit score, most likely, there are just a few telephone lines.

Preparing automatic billing processes for paying your debts can save stress and time; you only need to keep a check on your balances.

Suppose you could settle your debts in total amounts. DeNicola has it that “a mistaken belief is that claiming to have a balance on credit cards could improve credit. Count your mind off the false notion! Rather than wasting funds, pay your expenses the total amount if possible.

Feel disturbed to take credit?

When it comes to the risks of getting credit, it’s not disgusting to feel disturbed about it, particularly if you have already suffered a loss in the past.

Moreover, the fundamentals to enjoying good financial standing are improving credit and keeping a positive credit score. However, this could help mark-down prices on interests and money borrowed.

As mentioned in this article, all you need is to ensure you handle your credit appropriately; that way, you’d hardly have issues.

Signing up for multiple accounts all together

It’s no doubt that the more significant credit lines a customer has available, the higher the credit at hand should be. However, let’s assume you request multiple accounts in one go; the credit score could be affected negatively by the whole hard pull.

In addition, maybe you have faced problems handling credit before; when you have multiple credit accounts, this can pose a severe risk.

We suggest you create just 1 or 2 accounts first, then consider always paying your bills without delay. After That, if you think you’re up for it, go ahead to request different credit samples.

Reach the highest limit of credit cards

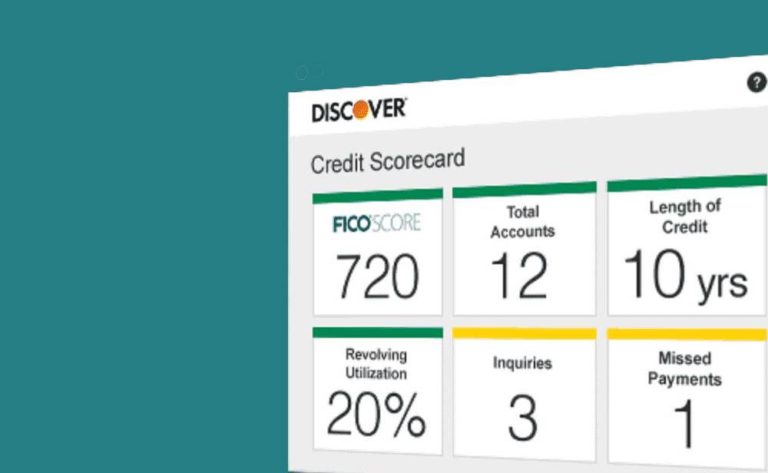

As discussed earlier on credit utilization, a user should account for higher credit at hand compared to the one they currently use to boast a big FICO score.

Use the calculator tool disclosed before, then do your best not to stretch beyond 30%.

Conclusion: Best way rebuild Credit

Developing or rebuilding credit is not as complicated as you think. The logic is to address a particular aspect one after the other until you eventually respond to all other factors completely.

Now that you understand the Best way rebuild Credit, the primary thing to do first is try not to make a payment late. In other words, you’re prompt to pay your bills. Sincerely, it takes discipline.

Indeed, specific issues may arise; possibly something can happen that you could find missing a payment.

However, it is to your advantage to negotiate with lenders, assuming you have a good reputation with their business. You can reach for support paying your bills should your credit score show you have a low possibility for more credit benefits or opportunities. Be wise!