Credit Saint Reviews: The greatest of all credit repair companies

Introduction

(Read everything you need to know about Credit saint reviews here)

At one time, you may want to find out about the most rated credit repair company “Credit Saint.” Here’s a chance to get insight into a complete description of what Credit saint is into, with other relevant information. Enjoy reading one of the best credit repair company reviews.

A Summary of what to expect in this credit saint credit repair reviews is as follows;

- A Brief about Credit Saint Services?

- How much is credit repair at Credit Saint Company?

- Credit Saint’s Payback scheme

- How long to repair credit at Credit Saint?

- Credit Saints advantages and disadvantages

- Credit saint Google reviews: Customer’s remarks about Credit Saint?

Now, in detail…

First choice

$79.99 month

Looking for a credit repair companies near me in New Jersey? Contact Credit Saint today, and don’t miss out on its 90-day guarantee for repayment, hasty call center agents, and a cost open to all. The Better Business Bureau judged the Credit Saint Company A+.

A Brief about Credit Saint Services?

Good to see Credit Saint in the category of the best credit repair companies. The company is located in New Jersey and started operations almost 15 years ago. Despite Credit Saint’s long years of existence, websites, for example, Consumer Affairs, keep rating Credit Saint above industry standards.

Besides, Credit Saint is just one of the credit repair services awarded with a high grade by BBB; therefore, some others have this grade. Also, the firm had its license way back in 2007.

In the list of credit saint’s objectives, the firm is committed to enlightening members on credit, making them realize that “anything they’re ignorant of is likely to hurt them.” It sounds reasonable, and I certainly consent to that, anyway.

Is your credit score dropping? Don’t panic. You have no choice but to delete the negative information from your credit report. If not, what you should consider is a complete credit repair; it’ll be a good idea if you consider hiring a credit repair company such as credit saint.

How much is credit repair at Credit Saint Company?

Below are the estimated costs of Various Packages at Credit Saint Company

Credit Saint considers three separate offers for its customers. The effectiveness of the various service plans to repair credit are of different magnitude. I’d start with the premium first.

- Clean Slate. $195 setup cost with $99.99 per month.

- Credit Remodel. $99 setup charges with $79.99 per month.

- Credit Polish. $99 setup charges with $59.99 per month.

Below is a more detailed evaluation of the features to expect from every service plan.

Clean Slate

- There’s no limit to the number of Disputes between the three credit reporting agencies.

- Debt summary

- Inquiry control

- Debt logger

- Creditor Intervention

- Tracking access by Experian credit repair

- For each Dispute round, Sky blue considers tasks related to disputing many incorrectly recorded items.

The best effective or hard-hitting of all the plans is the clean slate. Favorably, the plan covers all credit saints’ offers up to the toughest items to remove on the credit report. A clean slate plan is most appropriate for anybody suffering complex issues with credit.

The Creditor intervention there is that Credit saint management assist you get in touch with the debt collector including the creditor for your sake.

Credit Remodel

- Allows Disputes to the three credit reporting agencies

- Inquiry control

- Debt summary

- Creditor Intervention

- Debt logger

- Tracking features by Experian

- There are activities related to disputing ten incorrectly reported information for each dispute round.

Aside from Clean slate, another effective package of Credit Saint is the Credit Remodel plan, which comprises a lot, apart from the unlimited dispute feature. In short, The Credit Remodel plan is the best appropriate for anybody looking forward to sorting out just a few items such as repossession or bankruptcies.

Credit Polish

- Allows Disputes to the three credit reporting agencies

- Debt logger

- Debt summary

- Creditor intervention

- There’s activity related to disputing five incorrectly reported items for each dispute round.

The simplest plan of all others is Credit Polish; note that it’s most appropriate to use the plan for slight issues on the credit report. Unfortunately, you can’t benefit from the company’s unlimited dispute feature or multiple items to act upon with the credit polish package; likewise, does it not address items like bankruptcies, judgments, and repossessions.

90 day guarantee for Repayment (Credit Saint Payback scheme)

Suppose Credit Saint’s effort to remove negative information from a member’s credit report did not turn out well. In that case, such a member is fit to take advantage of the 90-day guarantee for repayment.

The company’s web pages clearly state: “Once you enroll for any of the offers at Credit Saint, then the rep’s effort to remove the negative items from the credit report within 90 days proved abortive; you should get a complete repayment.”

These same provisions of credit saint on refund guarantee are available right here.

Credit Saint Advantage & disadvantage

Credit saint reviews: The list below presents a few points to consider towards deciding if Credit Saint is okay or not to serve you.

Advantage

Better Business Bureau grades Credit Saint A-plus

With an excellent rating by Better Business Bureau, Credit Saint emerges as the best among other top-rated reliable companies for credit repair.

A Pricing system open to all

The credit saint cost pattern is very clear to understand.

Specially made circulars for Dispute

You can’t see Credit Saint use the regular circulars to submit Dispute for the information; rather, the company comes up with specially made letters peculiar to them to support their complaints.

90-Day Guarantee for Repayment

It’s inspiring to see Credit saints give a repayment if they couldn’t delete negative items from a credit report.

Features on a low budget or Discounted Offers

The money charged every month at Credit Saint is among the cheapest to find across the sector compared to alternatives like Lexington Law. Please take note that you only make payments for the solutions you require.

Disadvantage

The initial fee or first work fee is too much.

The setup charges at credit saint start from $99 – $195, and it should be one of the most expensive across the sector.

It’s not all jurisdiction Credit saint is accessible to the public

Do you reside close to or precisely in South Carolina, Kansas, or Georgia? Unfortunately, Credit Saint is far from you; therefore, you can’t engage the company for credit repair assistance.

Credit Saint do the following for credit repair process

Since a consumer has the freedom by law to confirm the correctness of any item on a credit report, the company is after your interest as the law already established it.

As stated in the Fair Credit Reporting Act, any item incorrectly recorded on a credit report is meant to be deleted. And the removal could be through any initial moneylender or credit reporting agency.

Credit Saints’ policies for operation are a pushover with understandable processes to aid patrons in fixing their credit reports. Next, we’d look over these processes very fast.

#1. Assigns special expert

First, each subscriber at Credit Saint is assigned a special expert to give advice; also responsible for handling your situation. They are also ready to respond to anything that bothers you and assist you in having an idea of the current situation with your credit.

Anyone among the workforce assigned to you can reach you first to review your credit report thoroughly; also make you realize how they could be of assistance with the current scenario you’re facing.

While the company does the briefing or credit counseling for you and gives suggestions, one more thing this personnel does is suggest ideas on the possible actions to take towards boosting and keeping a good credit score.

After you’re assigned a group of experts able to give advice, the company makes a move to improve the credit report.

#2. Dispute negative information

Credit saints commences this stage by contacting the lender you took a loan from, including the credit reporting agencies, focusing on submitting a dispute for any incorrect or negative information you probably noticed on your report. Then, Credit saint comes up with a special dispute parcel with the content focusing on your case.

Also, in line with the actual service plan of the company subscribed to (credit remodel, clean slate, and credit polish) determines how effectively the company will handle various information like repossessions, bankruptcies, or even go as far as to dispute charge-offs, including late payments.

In 45 days, Credit Saint makes provision for one cycle of disputes—after this cycle, the company then checks the report again to see any possible improvement in the credit score. Then, it comes up with a summary of the progress.

Day in and day out, you can sign in on your Credit saint online dashboard, with which you’d be able to keep a check on any positive changes so far with the credit repair.

Good news! Roughly 95% of subscribers to Credit Saint declared they noticed few positive changes at the initial round of 45-days.

How does Credit Saint repair credit?

Kindly note that the major factors that impact the credit score are only five in number.

The contribution of credit Saints Company to repairing my credit is as thus;

They attend to the main factors impacting credit score on a credit report, though it may not be all. Further, the company achieves that by disputing information such as errors and late payments on the credit report—credit saint evaluates the report carefully enough, checking if there’s an error and information likely to be deleted.

As stated by the Federal trade commission, one in five of the public in the United States has one inaccuracy on the credit report. It’s roughly 40M credit reports.

Also, the credit report’s errors are likely to affect the credit score greatly.

Check this illustration; a person borrows money on account of your SSN; i.e., it’s wrongly reported. Later on, he’s unable to pay back the loan. It’s very rampant to see such mistakes and can drop a credit score so fast.

Note: What led to some errors on the report is not genuine.

As stated in a research carried out through Javelin lately, has it that in the year 2017 only, over 16M credit beneficiaries in the United States suffered from identity theft? The culprits escaped over $16 billion from credit users that exact year.

In most cases, the culprits achieve their mission by registering credit accounts in the name of an account belonging to someone else—that’s why some check their credit report, only to find out several activities on the account not started by them. Not just that, the credit score may go down beyond imagination.

For a situation like that, credit repair companies like Credit Saint take steps on your behalf, then resolve the fraudulent actions, though you pay them for the service.

Such cases might need the most effective credit saint packages and thus permit the credit repair service to keep disputing the problem on your behalf.

Other Credit Saint responsibility

One more point you should know about Credit Saint’s responsibility is that they counsel customers on how to go about other factors impacting credit score for repairs.

For instance, once the company sees a consumer’s credit utilization is high, they may suggest you create a new credit limit and then pay any amount you have at hand. Another option is to consider the various classes of loans.

Perhaps what you only have in the first place is credit cards; you had better borrow money for another thing, like a personal or auto loan.

Less interest

When your credit score is low, you may think that this can slow you down in so many aspects.

Your credit score is low? Borrowing money from a creditor can be difficult. The truth is, when someone is denied a loan request, that’s when they come to realize hiring a credit repair company.

However, despite having a poor credit score, you can’t dodge paying a very high interest even though you eventually get a mortgage.

Check this, assuming a credit report has a credit score of 550. For an auto loan of 60 months, the account holder may spend roughly 17.186% interest.

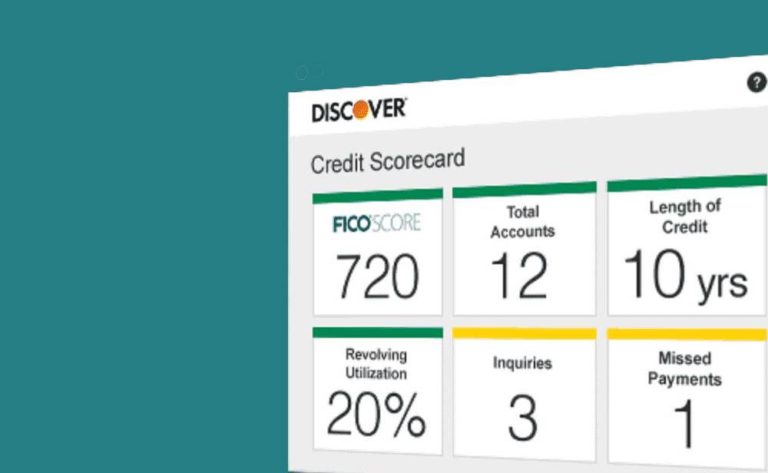

Meanwhile, when you can achieve a credit score beyond 720, the rate can be 4.55%. Therefore, it makes a huge difference from start to finish for a mortgage.

Open to more favorable jobs

Nowadays, policies for new companies incorporate identity verification; in most cases, they ask for a credit search. It’s so rampant. They do this to be sure they recruit workforces capable of being trusted.

Anyone can go broke; that’s not the end. In the same way, poor credits do not suggest you are an irresponsible fellow.

Moreover, a person that’s yet to reach you face-to-face can only work on the numbers they can for assessment. Sadly, credit reports of poor credit scores are denied better opportunities.

Credit Saint can’t do the following for you;

Bear in mind that none of the credit repair services can guarantee to increase credit score by a definite point or give assurances to delete the information on the credit report.

Irrespective of the excellent performance of a credit repair company’s services, they have to comply with some specific rules.

One of the rules is that lenders shouldn’t bother to delete any correct information on the credit report. Henceforth, if you notice a credit repair company pledges to do such, we thoroughly suggest avoiding such.

How long does it take to repair credit at Credit Saint?

Credit Saint Repair takes about a 45-days round for each Dispute, while many subscribers at this company tell they could notice a bit of change in this first cycle.

Moreover, keep in mind that on several occasions with the step to Dispute, some other discussions here and there are in place that cause delays.

At this stage, the company may ask you to submit more documents, likewise another dispute.

If you maintain a relationship with Credit Saint Company, you can notice changes. However, you’d hear from them when they perceive they’ve done all they could.

How to register Credit Saint Services?

The procedures to register for Credit Saint company are pretty straightforward—you have the option to contact the company by telephone, free of charge. Credit saint’s phone number is 877-637-2673.

Another option is you may decide to register through the company’s online document and then exercise patience for some time to hear from a representative, which can be through a telephone call. After registering, access the credit saint portal and use the credit saint login icon to continue.

You expect to benefit from a briefing or credit counseling free of charge to know which of the company’s service packages are appropriate for you; likewise, there is no condition of the agreement.

Besides, you may decide to abort the contract whenever; to do that, dial the company’s telephone digits free of charge. Another option is to send a message via mail to cancel.

Credit saint Google reviews: Customer’s remarks about Credit Saint?

Times without number, Credit Saint had very good reviews; and was well respected on top-rated websites online. Those who have hired credit Saint at once commented that they are inspired by the company’s friendly and responsive customer experience.

A member told Consumer Affairs about their agent’s endorsement of Credit Saint while he had already disapproved of a loan. Following a year, they’re eligible to get the loan; the interest to pay is only 4%.

In response to Credit saints increasing credit score up to 80 points, someone else appreciated credit saint. Whereas a customer commends Credit Saint Company for a credit increase up to160 points, some attest to an increase in FICO score starting 525 – 740.

Another amazing customer was amazed that a Credit Saint workforce persuaded her to purchase the cheapest service plans that suit her requirements, which some may sweet talk her into getting the most expensive package. Those are few instances of credit saint reviews had from members.

Conclusion: Credit Saint reviews

When you decide to improve credit all by yourself it is somehow difficult—and while you negotiate with moneylenders; in some cases, it can be exhausting. The proper way is to handle it over to dab hands experienced in the business. Looking for a credit restoration company today? You can’t regret hiring credit Saint Company. This credit saint reviews should guide you.

When you list credit repair services with high profiles and good reputations, this particular restoration company takes the first position aside it’s included in the list. The firm understands well enough strategies to increase credit scores. Likewise, it’s equipped with an idea to deal with the nasty laws virtually everyone has very little information about.

Though many companies exist in the credit line of business, Credit Saint remains the best of the best. The company’s reliable packages, A+ rating by Better Business Bureau, with good comments from users distinct from other top-rated companies.

Feel free to read more on other credit repair companies in my area

- Ovation Credit Review

- Sky Blue Credit Review

- CreditRepair.com Review

- Lexington Law Review

- Credit People Review