Remove Late Payments from Credit Report yourself the easy way

Introduction

The aftermath of Late payments can be so bad on a credit report that you can be denied of credit cards and an overdraft. Therefore, it becomes necessary you remove Late Payments from Credit Report to get off these restrictions.

So far as late payments remain on your credit report up to 7 years, it may reduce your credit score for a very long time and make it miserable.

The good news is that you can remove late payments from credit report; follow the decisions under:

You can remove Late Payments from Credit report

- Negotiate and Refuse any inaccuracy or omission

- Take advantage that you’re a persistent and unfailing client.

- Seek for a total debt validation

- Bargain for a removal

Next, we’d have a thorough look into the above procedures separately and others.

The late payment on credit report can be an error.

The Federal Trade Commission disclosed that 1 out of 5 persons have errors on their credit report. Sometimes, a mistake can happen that a bill paid when expected can appear late on record. For this reason, you should always run through your credit report every day.

The Federal statutes make clear your freedom to get a free sample of credit reports annually. Browse annualcreditreport.com to have a copy.

Get a Credit Report without paying a dime; continue reading to know how that’s possible.

Since items are likely to be different among the three best credit agencies, you should check your credit report thoroughly with TransUnion, Experian, & Equifax.

It’s easy to see late payments on your credit report. Check under the “accounts” category of the report, and you’d find it there.

For every account, some of the information the creditors disclose are as follows;

- The actual date the account is signed-up

- Outstanding payment.

- The transaction records,

- Limit

- Loan sum

- Type of account (for instance, a bank loan or charge card).

While checking each account, pay attention to it well enough so you can see if there are any incorrect data.

2 possible Errors to observe on credit report

The following are the two likely errors to search:

Prompt payment recorded to be late

In a situation where you pay bills when expected monthly, unfortunately, some part of your accounts still appears a late payment. Don’t assume it’s normal and correct—look at your monthly credit card bill with the bank history and compare it to what you have in your credit report.

Suppose you are not used to keeping slips or documents; another alternative is to retrieve your payment records on the internet.

Also, suppose you can get an email or a memo validating your payment provided by the creditor. In that case, it’s another means to confirm you pay your bills not too late.

Once you’re able to show that you pay your expenses as expected, the loan company is legitimately under compulsion to remove a late payment from credit report.

Any late payment that subsists beyond seven years

See that you confirm the particular day of your first default.

Count seven years from the day of your first default or late payment; you’d have Late payments remove your credit report by itself.

Possibly, you may notice all kinds of negative information per billing period—30 days, 60 days, 90 days, 120 days—. In contrast, the 7-year time frame begins to count with the first late payment that lasted for a month.

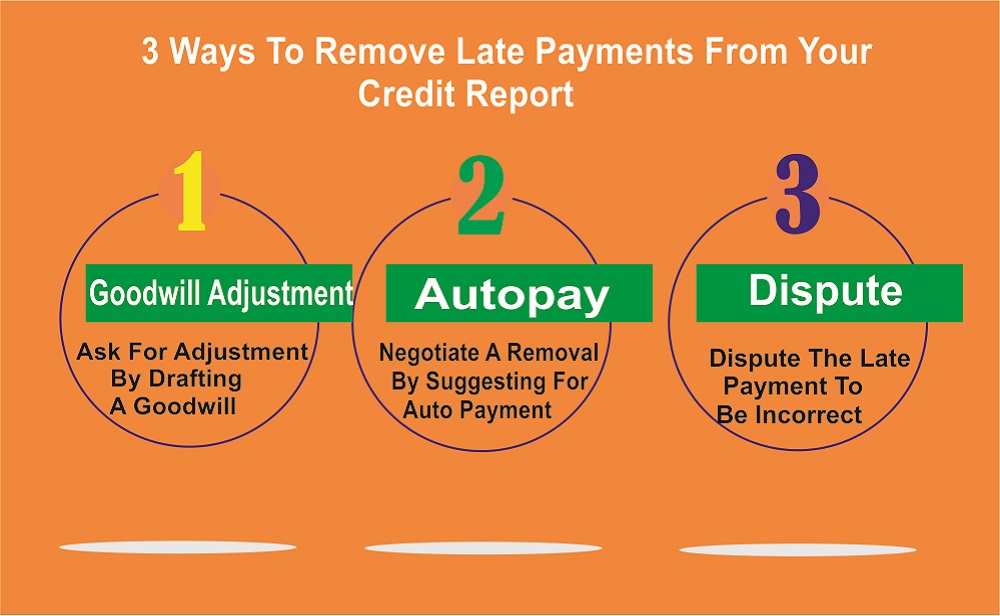

Arranging a Dispute if you see any mistakenly recorded late payment

It would be best you disagree and arrange a dispute whenever you notice any mistakenly recorded late payment or that which has existed for more than seven years. You should submit a dispute with the credit agency aside from your creditor.

By the constitution, your creditor must look into a disputed report in less than a month of accepting the dispute notes. Notwithstanding, if you send more items to the creditor, they may use up to 45 days.

The national regulations instruct creditors should detail only the correct info of clients. And suppose the creditor is unable to validate that its report is accurate. In that case, they are obliged to inform the credit agency.

Not only that, you need to submit a dispute personally with the credit agencies. Be that as it may, make sure you notify only the credit agencies disclosing the information you plan to dispute.

In particular, supposing a late payment appears on your TransUnion record and not that of the Experian record, you are meant only to submit a dispute note to TransUnion.

The credit agency then has a span of one month to look into your demand and get back to you.

If the late payment on your credit report isn’t an error?

After examining the credit report, compare it to your bank reports. Observe and be convinced that the late payment is not an error.

Should you dispute a letter for that or not? Yes, even when you are sure it’s not a mistake, you have the right to deny any late payment.

The reason is that it’s your responsibility by law to dispute any creditor’s history if at all the late payment is not a mistake or not.

You must know that not every creditor keeps detailed documents; they will find it hard to confirm the details. And, in a situation long after this happened, the creditor may no longer have the reports required to verify the late payment.

If the creditor fails to provide proof, do you know you can push the blame to him for his inability to give evidence? Now, you hope he’s not able to defend the late payment? That’s the trick to remove late payments from credit report.

Imagine measures to rebuild your credit as a prank: whenever you see any slightest chance to manipulate things, be fast to make good use of it.

Five alternatives to consider

1. Refuse any inaccuracy or omission of a minor item

The Fair Credit Reporting Act spells out your liberty to dispute any incorrect items found on a credit report.

“Incorrect items ” here may be a wrong spelling of your name or an error with the actual day your account is signed-up.

If you spot even a minor mistake, send a dispute since the credit agency or lender may find it hard to validate it. If the lender cannot prove the claim, they can remove late payment after some time.

2. Assuming your credit report have an unusual late payment

There are cases that even the most disciplined, very dutiful customer can ignore a late payment sometimes.

If your credit report is of no error apart from the only unfortunate late payment, try by sending your lender a message requesting him to delete such.

Once you file for the removal of the late payment, don’t act as if you’re guilty.

Instead, tell the creditor that you are a regular client. Also, let him understand your solid reputation for paying bills without delay all the time. You can even further say it shocked you to notice a late payment on your credit report.

Round up by saying the late payment should be an error. Also, you are desperate to find a solution to it immediately to maintain your respect as a fervent and persistent client.

The trick with this strategy is that credit bureaus are after their customer’s satisfaction and wouldn’t like you to feel bad.

Suppose you honestly have had a solid relationship with your lender for a very long time & have never been late paying your bills. In that case, the creditor may remove late payment on credit report as an act of kindness to your promptness. Also, the creditor doesn’t want to lose your relationship as a loyal customer.

2. Seek a full debt validation

For example, let’s assume your claim for late payment removal proved abortive. And, you’re unable to convince your lender to remove a late payment from credit report; you have the option to request full debt validation. Maybe you don’t know; according to the Fair Debt Collection Practices Act (FDCPA), it’s your freedom.

Usually, you will embark on the procedures to debt validation in less than 30 days that you get a note of outstanding payment from a lender or debt collector. As stated in the Fair Debt Collection Practices Act, representatives & creditors are to confirm a due payment, not more than a month long.

Once it elapses 30 days, the collection agents and lenders may willingly validate an outstanding payment. However, the law does not expect them to do such.

Now that you know what debt validation is, you may ask how to put in an application for debt validation?

1. Put down a note of your request

You have to make a note for your debt validation letter on paper. If possible, address the message through an official email along with a reply slip request—as demonstrated, you will be able to justify that the creditor received the message. So long as you address the letter within a month, then you can prove you sent the request to the creditor early enough.

As written in the request, please address your questions to the creditor so he can specify the initial lender’s name, a duplicate of the first monthly credit card bill. Or any sanction that binds both you and the creditor together. Also, the date the money owed starts initially.

Endeavor to ask a debt collector their authorization eligibility to receive credit in their territory if you reach them.

2. Send items to the credit agencies

Sometimes, a collection agency or lender can respond with a report itemizing the amount you have as outstanding. All the same, the approach is not okay to give proof for a debt.

If the lender or collection agency fails to present any evidence or report proving your debt, send such reaction of the creditor to the credit agencies. Then request a cancellation.

3. Suppose the creditor give proof of the debt

Suppose the lender or collection agency replies with substantial evidence to prove your money owed. In that case, other choices you can resort to are not many.

Before anything else, confirm the procedural rule for outstanding debts in your province. Assuming the law prohibits the lender from taking legal action against you due to the passing of time, footing your bills may be of no use.

You may consider paying your bills with your creditor. Often, a lender or collection agency is ready to receive a share of the actual debt amount provided that you make payment in a round figure.

The creditor may accept to remove late payments from your credit report; however, it’s not sure.

4. Bargain for cancellation of the late payment

Sometimes, you could have a creditor cancel a late payment by suggesting that you enroll to automatically pay your bills. It demonstrates to your creditor how committed you are to ensuring your account is up-to-date.

Make inquiry from your creditor whether they can accept to remove a late payment from your credit report as a reward for automatically taking on their procedure to pay your bills.

5. Engage a credit repair specialist

It can be annoying and strenuous to have your late payment deleted. You’re most likely not to have the time and other essentials to audit all the papers reports required to submit disputes & get back to creditors, debt collectors, & credit agencies.

And if they treat you harshly, you can engage a specialist or corporation for credit repair to take care of the dispute procedures on your behalf. If you decide on this method, do your best to engage a professional, respected corporation.

Read our articles on the best credit repair corporations to understand their concept.

Consider “goodwill” message to remove late payments from Credit Report?

You may have checked all options & have no other left to remove late payments from credit report; there’s still hope; you can send a “goodwill” message.

This way, you’ll address the “goodwill” message to your creditor, admitting your actions not to pay bills on time. Then beg for alterations on the credit report, and that will be the only time you’d plead to make such repairs.

If truth be told, the approach of trying to write a goodwill letter for deletion of your late payment seems reasonable. Moreover, the chances to turn out well are slim.

The reason is

In most cases with his option, the creditor response will be that the statute demands that you relay the correct information to the credit agencies.

The truth is that since you accept the error is from you as expressed in the goodwill message. Many creditors will likely turn deaf ears to the letter and not delete the negative items.

Does a late payment modify the credit score, if it does, how does it happen?

You could have more wreck done to your credit history beyond what you could imagine with Late payments. A late payment lasting a month can reduce your credit history by 100 scores.

How bad the late payment could affect your score is a factor of your credit history in the first place.

A good illustration is that an individual with a credit score of 700+ scale is likely to experience a sharp drop. In contrast, another individual beginning with a low credit score is expected not to suffer much loss.

To what length does late payments remain on credit report?

You can have a late payment remain on your credit report for at most seven years & which is likely to reduce the credit score as it thus stays in the credit record. Later, your late payment should disappear.

However, don’t imagine it will take effect without you making an effort.

Suppose your account has a late payment with a duration of 7 years. Observe your credit report so you can be sure the late payment disappears at the right time.

And assuming it remains there, you can sort for a negotiation with your creditor with the credit agencies presenting it.

You should focus on late payments, know why and remove Late Payments from Credit Report

The crucial determinant is the banking record of discerning one’s credit score.

From the five determinants FICO® employs to determine one’s credit score, the banking record accounts for 35%.

Creditors adopt the credit score to determine if you are heading for doom & whether you are not loyal to paying your debts when expected.

There’s a tendency for the creditor to refuse to increase your credit. Hence, getting a home or auto loan can be difficult, or you may eventually pay high interest.

Since your banking statement matters a lot for credit reports, merely just a late payment can significantly affect the credit score.

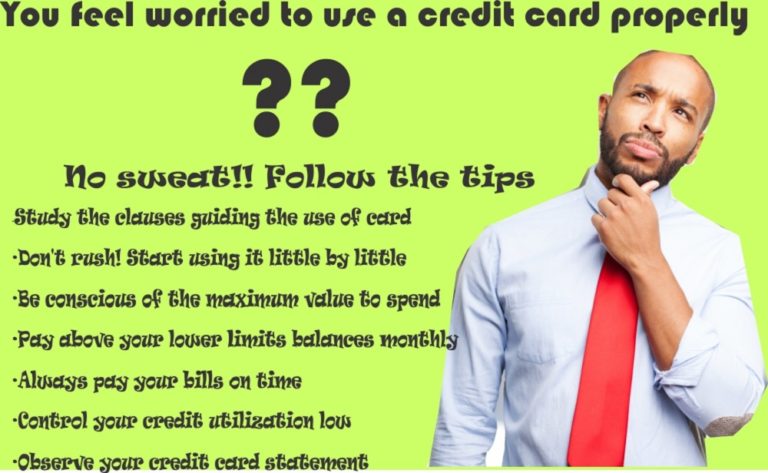

It can be difficult to remove late payments from credit report ahead of time; however, it’s a good move.