Request annual credit report for free in 5 simple steps

Introduction

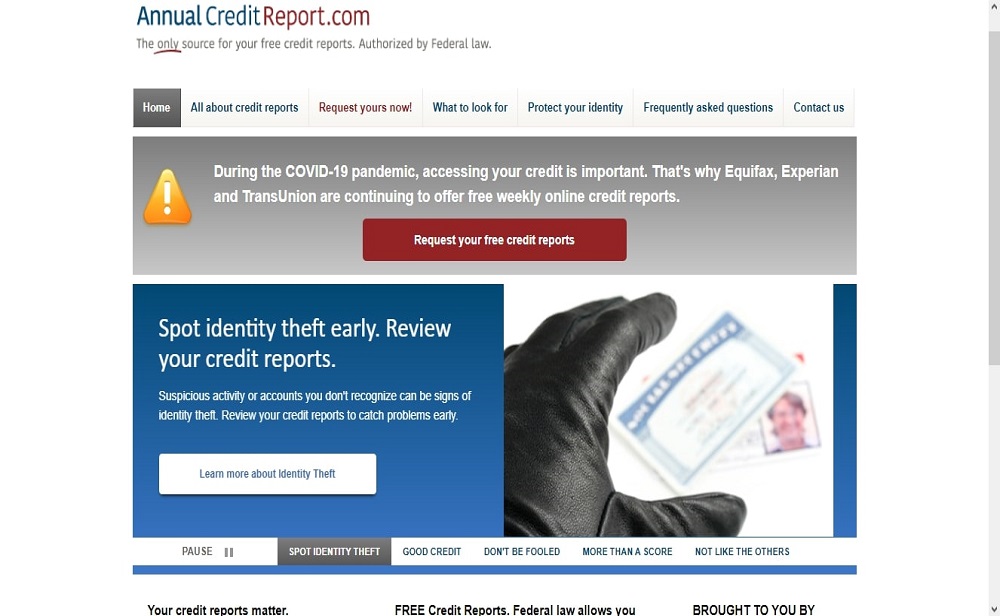

Of all the input you’d treasure to keep a superb level of finance is checking your credit report frequently. To do this, visit https www annualcreditreport com to request annual credit report for free.

Besides AnnualCreditReport.com, no other credit report website has authorization of the national authorities to allow credit users check their full credit report ( three) without payment. Moreover, the website is controlled by the 3 top credit reporting agencies.

AnnualCreditReport.com means what?

AnnualCreditReport.com is an online domain for credit report checks managed under the authority of the three top credit bureaus.

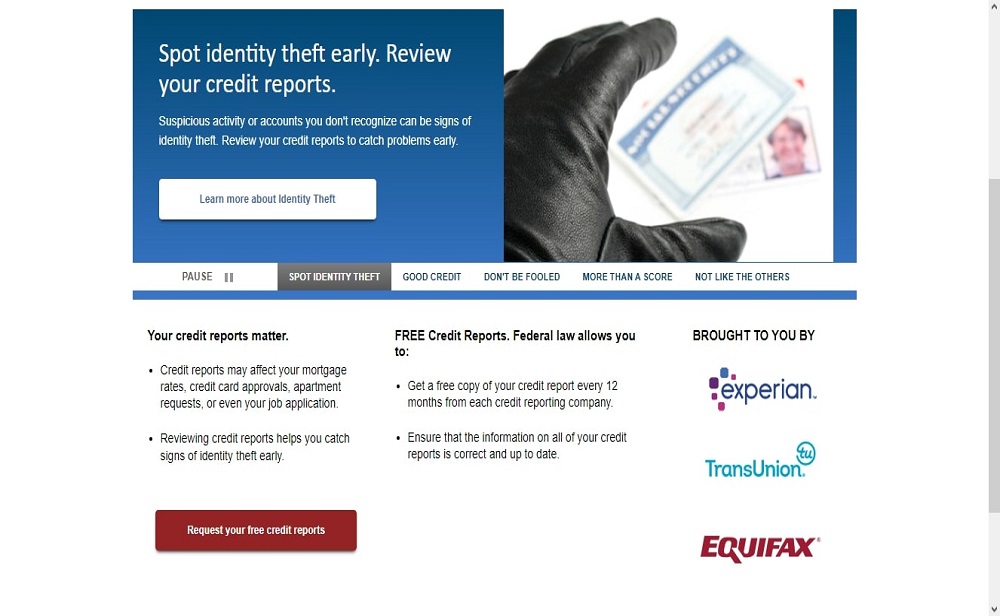

As you may know before, TransUnion, Experian, and Equifax. These credit reporting agencies introduce “AnnualCreditReport.com,” based on the update on (FCRA) Fair Credit Reporting Act. The update instructs to provide the public a single credit report for free each year. In that respect, credit users are entitled to a credit report every year without paying a dime.

On the web pages of AnnualCreditReport.com, feel free to check your credit reports without payment. Also, the public enjoys added benefit to submit a dispute letter on the Net if you notice any error item on the report.

Though you’d find several websites in the industry claiming to do the services of AnnualCreditReport.com. However, you need to be careful as the only authorized website the national authority consent to do all that for free and by the Fair Credit Reporting Act is AnnualCreditReport.com.

With the global Covid-19 infectious, AnnualCreditReport.com disclosed it gives credit reports for free weekly, though that was April 2021. Credit users can access their credit report every seven days at AnnualCreditReport.com; it’s similar to obtaining the reports every year.

How many free credit reports are you legally entitled to each year?

As a credit beneficiary, you can only request free credit report just once yearly.

Benefits and Downsides to request annual credit report at AnnualCreditReport.com

AnnualCreditReport.com is absolutely a legalized platform. No other government-licensed venue exists to pick up credit reports for free. Though this provision has issues, it isn’t as important considering the load of benefits. The pitfalls are something to waive.

Benefits to request annual credit report

What majorly attracts using AnnualCreditReport.com is that users benefit from a general dealer to get the full credit report (three). In other words, they don’t need to visit several stores to get the full credit report (three) at one request. And, the service doesn’t require spending a dime from your wallet.

The credit reporting agencies introduce the AnnualCreditReport.com from the official directive following the rules of the Fair and Accurate Credit Transactions Act of 2003.

Hence, It grants the public the freedom to get their credit report once from the three credit reporting agencies annually.

Downsides to request annual credit report

Though the AnnualCreditReport.com platform is the only means for credit users to be briefed about their credit, the website yet has its pitfalls. Check below for the disadvantages of using AnnualCreditReport.com.

Does not reveal credit score.

If you resolve to check your report through AnnualCreditReport.com. There’s no way to see your credit score since the credit reporting agencies only give access to credit history.

Moreover, you may register at Discover Credit Scorecard to check your credit score without spending any money for the service.

The long 45-day dispute

Generally, the national rule requires the credit reporting agencies to write back within 30 days, subsequently you dispute information on the credit report.

Suppose that you submit a dispute on the Net via ” AnnualCreditReport.com,” in that case, the agency then has 45 days.

Counterfeit Fraud websites are everywhere

You’d see other websites with labels or URLs like AnnualCreditReport.com. You can bear witness across several www annualcreditreport com review. As a result, you need to exercise caution and be careful you sign up at the proper website before filling in the blanks with your data.

You’d come across many websites that look like annualcreditreport.com. They cajole credit users into making payments to get a report they’re meant to obtain without payment. Their target is not to mount pressure on AnnualCreditReport.com nor use it as a device to criticize.

How to request annual credit report via AnnualCreditReport.com

It’s pretty simple to learn how to request annual credit report free by AnnualCreditReport.com. Follow the below instructions to pick up your credit reports.

Browse your way to the AnnualCreditReport.com website

Visit https www annualcreditreport com. As discussed earlier, there’s no other website aside AnnualCreditReport.com platform; that the United States federal authorities grant permission to give credit reports for free. By the time you check the landing page of AnnualCreditReport.com, you can notice the snapshot below:

Complete the blank with your personal information

Due to safety reasons, AnnualCreditReport.com demands that you send in a few crucial details. Along with, your birth date, whereabouts, SSN, and name.

Request annual credit report

TransUnion, Equifax, and Experian; are the three top platforms to request credit reports. You had better ask for the full credit report (three). Why is that? It’s advisable since the data on the Equifax free credit report may not be the same as that of Experian free credit report.

Respond to the security questions accurately

After choosing the reports you wish to get, the command prompt on display urges you to respond to the security questions accurately. You do that according to your details, including the accounts shown on the credit reports.

An illustration is if you bought a car on loan within a particular year. Expect questions like the car configuration, brand, and when actually the year)you had a home or car loan.

Why the security questions, in essence? It confirms the current user on the website is not a cyberpunk manipulating to steal another person’s credit reports.

Sometimes, several users forget the answers to questions, struggle hard to get it. An example is the information of past bank records. They can’t remember details about financial transactions carried out in the past. If you encounter similar issues while responding to the security questions on display. Kindly resort to requesting credit reports through telephone or email.

Request annual credit report mail

Extract the mail request document from the Net, and fill in the blanks to obtain credit reports through email. After that, send the document filled to

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Maybe you’d rather prefer to use a telephone to request credit reports, put a call across through 1-877-322-8228.

Fetch the credit report

After you properly respond to the security questions for the credit report one after the other. Then, you may proceed to fetch the credit reports from the site and respond to the agencies for confirmation if necessary. Please look at a simple guide reading credit report for beginners; it’s a template to know your credit report.

Why you should check your credit report yearly; see 5 Points

The data you see on the credit report affects your credit score, contributing significantly to one’s financial performance. A positive credit score helps with a good chance for big deals; on the other hand, a negative score could block the way.

When you understand the contents of a credit report, this will assist you in having dominion over your finances. Now, let’s see the points a credit user has to review his credit reports; whatever is the case, at least you should do that, even if it’s one time annually.

Detect any inaccuracies to dispute

If it happens; your credit report has inaccuracies which lower your credit score immoderately?

From research carried out via (FTC) Federal Trade Commission, 1 from 5 credit beneficiaries notice errors in credit history.

While you regularly check your credit reports annually, you can see for yourself the proper information to present or not. Likewise the incorrect, mistaken, or probably the account not yours. Peradventure you notice any errors, don’t hesitate to dispute such, and then delete as appropriate.

Observe outstanding payments omitted

Irrespective, you’re very observant and up-to-date with your payments or pay up money owed on time; there’s a tendency to have some unnoticed.

See this illustration; you suffer surgical treatment or probably an unexpected health disorder. You need to pay bills from several agents. And if you did not meet up paying the bill at the right time, it’s likely to appear on your credit history.

While you check your credit report periodically, it increases the chances of seeing any unpaid bills. Also, you get inspired to settle up the bills before your moneylender charges you for a case. It could cause the court to step on your income and withhold it to pay up the bill; another option is your asset can go for it.

You can quickly notice identity theft

As of 2018, a population of roughly about 14.4M citizens of the United States had experienced identity theft. Peradventure, anybody steals your identity to obtain credit or probably your profile not having sought your content. Anything he uses your account to do, either good or bad, will appear on the credit history.

Cut costs

If you take necessary precautions to use your credit well, it cuts costs with time. And by the time you get the idea of the five factors impacting credit score, you’d be bold enough to take steps towards boosting your credit score. In the long run, it helps cut costs to pay for interest while you request another credit next time.

Nothing to lose

You can see your credit reports via AnnualCreditReport.com free of charge. If the checking process did not go well, which is not possible, nothing is lost from you; then you had better make good use of the complimentary assistance?

Review on annualcreditreport.com

Just as the public says well about the effectiveness of the AnnualCreditReport.com website, likewise there are bad comments. Many of the bad comments emphasize technical problems while navigating the web pages. You can see enough comments at any annualcreditreport.com review website.

Besides, a few complainants say their opinions are not acknowledged because they could not respond to their security questions correctly. Should you forget the information of accounts used in the past, it doesn’t stop you from requesting free credit reports either by telephone or email.

These are some of the annualcreditreport.com review complaints below;

Some insist their effort to get reports from AnnualCreditReport.com prove abortive.

While a few say its slow loading of the credit reports.

Pay attention to credit report scams

Sadly, you may chance on counterfeit or fraud websites doing all they can to pretend to be AnnualCreditReport.com. Another way, they could make pledges so you can get credit reports without you spending money. Their motive is to defraud you. To prevent this, below are some warnings to pay attention to. Or traces of credit report scam.

A Counterfeit Web Address

If you’re very observant, many counterfeit websites attach guidelines like Annual Credit Report for their use. An illustration is this; such a website may write “free report” or “yearly report.”

Likewise, please take notice of website addresses that forges the label of AnnualCreditReport.

Some defraud using a web address before “AnnualCreditReports.” The report there with “s” at the back makes it manifold; this website uses it as a trick to fool customers.

So quick to pay

If you browse through the authentic website of AnnualCreditReport.com, the report is freely given to you; it doesn’t require money to spend before accessing your credit reports. Suppose that website demands money from you and it looks like AnnualCreditReport.com. Or probably it diverts to a different website that requests to pay cash, don’t think twice to exit. Be careful; those are traces of fraud schemes.

Sweet tongue to repair bad credit

Doubt any websites that sweet tongue they can repair poor credit; regard them as untrustworthy; these are credit report scams to trick you with their gimmicks.

If you see any licensed credit repair companies, they often tell beforehand, “they don’t give assurances.”

The rules also forbid Credit repair companies from requesting money before doing anything for you. Avoid any site or business requesting advance payment.

Misspell words

Take notice of any credit repair company or credit report site with misprints of its words or inappropriate language rules. That can indicate the website is worldwide and a warning about its authenticity.

Frequently Asked Questions on Annual Credit Report

Check out the FAQs, along with responses to the Annual Credit Report.

Is annualcreditreport.com legit or contrary?

The single website that the national authorities endorse to grant the public their report for free per the FACTA of 2003 and FCRA is AnnualCreditReport.com. A licensed platform.

Is Annual Credit Report secure?

As claimed by AnnualCreditReport.com, the website employs certain encrypted codes to secure users’ personal information. The page that addresses safekeeping guidelines at AnnualCreditReport.com states thus;

it encodes consumer information by the time a user completes the requested document for a credit report; likewise, during the moment the website forwards the user’s information to either popular credit bureau.

Besides, a credit beneficiary has to respond to the security questions before which they can get their credit history. The interrogations are clearly defined deliberately.

Before anyone could find a way to your account behind you, they must have had enough findings concerning the accounts. Also, with your finance records.

Which credit report is ideal among TransUnion, Experian, and Equifax provisions?

Credit beneficiaries pick up their full credit report (three) at AnnualCreditReport.com provided by the top 3 credit reporting agencies. That is TransUnion, Experian, and Equifax. You can’t find just one report superior to the remaining two.

Consider examine the complete three credit reports. Why? Since the details, including accounts on a credit report, may be not be found on the other. Several moneylenders limit their reporting to maybe 1 – 2 credit reporting agencies. Therefore, it pays to go through the full credit report (three) to have a broad view of the account.

Can Annual Credit Report affect credit?

Not at all. Immediately after you ask for your credit reports by AnnualCreditReport.com, that can’t cause a hard pull on credit. Likewise, it does not affect credit score.

Closing words on how to request annual credit report

If you claim to use credit smartly and lack proper facts about your credit, you miss something critical.

And if disturbed about the right channel to request annual credit report for free, look further no other than AnnualCreditReport.com. Through this site, you can check out the reports periodically.

AnnualCreditReport.com is 100% legit, the only government-licensed agency to give credit reports for free.

By now, you should know you can get free credit reports from all 3 bureaus in just a store.

Don’t miss out! Hurry to get your free yearly credit report today.