Why having credit is important in a society of poor economy?

Introduction

The possibilities of a Credit can’t be underrated; no way. You’d be amazed to achieve greatness when you put credit to use. Credits makes room for incredible opportunities your way that you may not have had the privilege of via a different alternative. For instance, you can foot bills for university education, buy a car or fund a new luxury apartment. Can you now see why having credit is important?

It’s common to see people saying, “how I wish I could buy this.” Unfortunately, they don’t have sufficient money to pay. With credits, you can do the impossible. No limits anymore!

Nevertheless, take note of this. Likewise, when you’re privileged with amazing power, be ready for extreme care to maintain it. Similarly, with credits, you can dare the impossible financially. Sounds good, right? At the same time, when you don’t use it responsibly or handle it the wrong way, it could cause much havoc to you.

That’s a major obstacle, for that matter, to your financial standing.

A basis for preventing credit-related issues is understanding how credit works and the necessary things to do to use credit smartly.

After reading to the end, you’d know all the basic facts (rudimental) about how does credit works and why you should build your credit report. Before proceeding further, you should know what credit is and why having credit is important.

Credit, what does it mean?

Along the line, you’d understand why having credit is important.

What is credit? For instance, you get credits from anyone or a credit card company. The idea is you take out a loan to address any pressing need or whatever you want to achieve. Or, you could have an item to buy urgently and then pledge to settle the debt after. That’s credits! It’s as simple as that.

For instance, you use credits even as you get a car loan due to insufficient money. Many individuals can’t bear the cost of buying a newly manufactured car as they are low on funds.

Just imagine all manner of things you can do with a brand new car, the comfort, luxury, and some other. Aside from that, moving on the street with a new car is pleasant. Likewise, moving along with it to the office, shopping, and keeping company with pals and relatives. While driving to your office it’s another opportunity to make money. Before you know it, you have already gathered enough riches.

Besides, credits is a booster for a nation’s gross national income. How possible is that? Everyone can get whatever they want, no excuse, only if you choose not to. It inspires companies to manufacture items for sale and services and drives buying and selling. While these firms make production, they generate revenue. Not just that, it’s an avenue for vast employment opportunities in society.

See 5 points why having credit is important

Undoubtedly, credits is useful; despite that, you also need to prioritize establishing positive credits. As long as you are mindful of how you manage credit, you certainly secure a financial position or level of affluence. Also, you believe things will improve sooner.

Brainstorm on the below five points why having credit is important:

1. Building credit report

If you can’t account for a credit report, that suggests you have yet to use credits, or your credit activity is dormant. In that case, it makes it very hard for moneylenders to evaluate your chances of default or not.

If it happens, banks doubt your reliability and integrity; they are not sure whether you can make timely payments or not. Sad to say, you may not be able to get mortgages and other loan types. Or possibly pay very high interest on any money borrowed.

2. it’s useful in Urgent situations

Some things happen unexpectedly (unforeseen contingencies). You most likely need money to address it; Credits is useful to meet such pressing needs that caught you unaware. Examples could be a car suddenly develops faults and needs to fix them quickly. Or, it could be a case of fire or downpour.

You had better reserve so you can withdraw fast whenever you’re desperate for money. Unfortunately, some don’t plan to set aside money for future use. a

Having a credit card is a good opportunity to turn to for fast access to money.

3. Security features

When traveling, no one has to tell you not to move along with a huge amount of money; rather drop it at home.”

Suppose you miss your handbag with the credit card contained in it. In that case, you can deactivate your account quickly and at your fingertips.

With cash put in a purse, you can’t do something similar; the instant a dollar is missing, that’s final. There’s no way you could either freeze it or get the money back.

4. Gifts and Bonuses

Credit card businesses would like to catch the interest of the public. Hence, they are ready to do everything possible to achieve that. Also, many of them get gifts, bonuses, and other fringe benefits to you via bonanzas packages such as price slash for guesthouses; recurring air service loyalty offers, discounts, and refund tips.

If you keep paying the total amount of money owed monthly (also no interest to pay), you could profit from these card firms.

5. Hiring a Vehicle

Before most car hire businesses can allow you a car, they make sure you must have handled a credit card first. It can be displeasing when you’re on tour and have no means to credits.

How to know a positive credit score?

Several factors contribute to determining credit scores; moreover, a great score starts from 750 upward.

In the table below, you can see how Experian categorizes the various FICO score limits:

| FICO Score | Grade | Percentage of Consumer’s |

| 800-850 | Excellent | 19.9% |

| 740-799 | V. Good | 18.2% |

| 670-739 | Good | 21.5% |

| 580-669 | Fair | 20.2% |

| 300-579 | Very Poor | 17.0% |

How a credit score work?

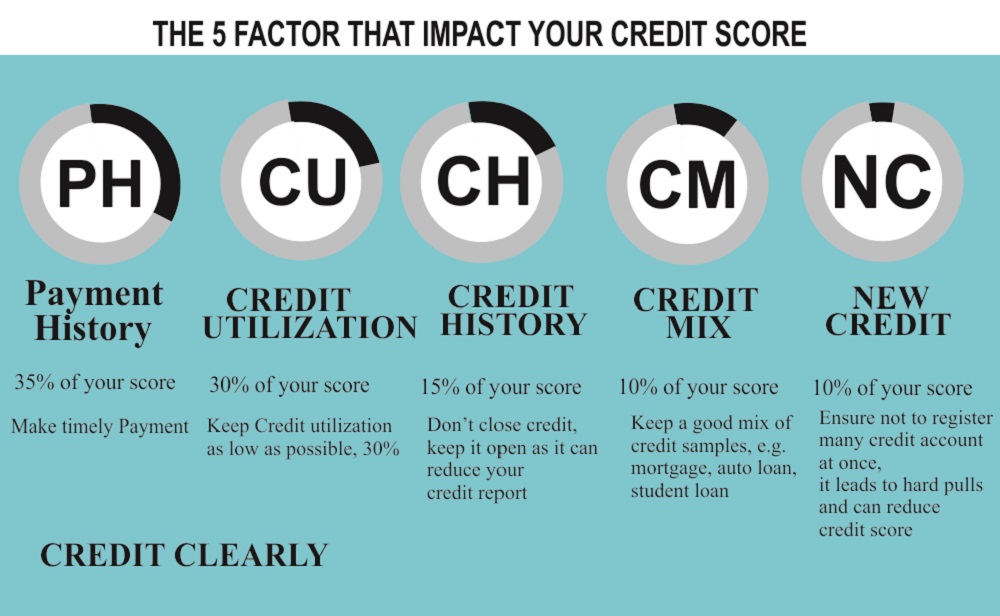

Although the main factor in the credit score systems is FICO, many creditors also resort to VantageScore. Notwithstanding the procedures put to use, a customer’s credit score rests on five factors —and each of these factors has its percentage contribution to the final FICO score.

Now, let’s see how credit score works

- Banking record: Make timely payments. 35%

- Credit Utilization. It’s the amount of credits you already utilize against the current credits. 30%

- Credit Report. From when you start using the credits till date. 15%

- Variety of Credits. It has to do with how diversified the credit samples are; the best is to consider a mix instead of having only one type of credit in excess. 10%

- New Credit. The number of newly opened accounts had already. 10%

Though every single factor is crucial, a consumer’s banking record affects 35% of the score

If you are behind schedule with just one or two payments, that shit could make your credit score suffer damage or loss.

5 Points to Build credit (No borrowing)

Since a credit score tells about the user’s performance history to using the credits, is it unnecessary to have lots of loans and credit cards to showcase your resourcefulness to creditors? No need; it doesn’t work that way.

Your report doesn’t need to show you had requested lots of loans before you can have an excellent credit score. — improve your score with the points below without owing any dues.

Look below for the five ways to put into consideration

1. Use a secured credit card to build credit

A secured credit card can be amazing if your credit history is too short or you plan to improve your poor credit score.

The use of a secured credit card makes you sacrifice a token value of money; that’s your line of credits. Supposing that you could not pay your bills on the expected date, the moneylender or credit card business can hold the security deposit or collateral.

Nowadays, you’d see diverse secured credit cards up for sale. Likewise, the money to deposit differs. There are some of these cards with collateral amounts of $50 – $100. Moreover, a few cards request a very high value to deposit.

Like a pushbike using stabilizers, the purpose for which a secured credit card is created is to boost the user’s creditworthiness sufficiently to upgrade to the regular card (not secure).

2. Use a credit builder loan to build credit

A credit builder loan is also a good way beginners can start using credits. An instance is a loan provided by Self Lender; it’s available in token amounts. The creditor keeps the money in reserve as you pay your bills.

In addition, the creditor tells of your bill payments to the reporting agencies. Like that, you make a reputation of paying your bills on time and a good report. Immediately after you have completed the payment of the loan in full, then you can get back the money initially held by the creditor.

3. Ask someone to Co-sign

You may not be eligible to get a loan alone. Still, some are to get through anyone ready to sign on your behalf (a guarantor or counter signer).

For instance, either your mother or father may be willing to countersign you borrow money to purchase a brand-new car. Like that, it’s an opportunity to establish credits and buy a new car. Also, you can secure a very low interest.

Meanwhile, your guarantor or counter-signer must get the risks associated with doing that. Suppose you cannot pay up when expected for the debt. In that case, the counter-signer should be ready to pay up the expenses.

4. Get a warranty to piggyback anyone’s good credits (Seek to be an approved user)

Do you have anyone with a positive credit, Seeking his consent to piggyback on his good credits?

Credit cards, for instance, tolerate a borrower to attach anyone as an approved user. You leverage the borrower’s card; even so, if the cardholder fails to repay what he owes, you’re not responsible for paying his debts.

Suppose your bloodline or guardians join you as an approved user to take advantage of their credits. See that the lender duly tells of your bill payments to the credit reporting agencies.

5. Subscribe to Tracking Companies for Rental payments

For instance, you temporarily pay for accommodation; you may sometimes decide to use the Rent payments to exchange for a credit-building tool.

Though many house owners are not used to disclosing their occupants’ bill payments to the credit reporting agencies, there’s a way to go about it. There is car rent tracking companies to subscribe to that can monitor and record money paid. They also tell of the activities straight to the bureaus.

Improve score with five good Credit Etiquette

You had better not suffer credit mishaps after using credits before realizing the value of adhering to good etiquette.

For instance, you registered a credit card as an undergrad and then had a huge debt amount that dragged down your score for a long time.

You had tried everything possible to get rid of previous credit flaws. Keep to effective practices to have your score ever increasing.

1. Pay your bills at the right time

A consumer’s payment record takes about 35% of their score. Eventually, you’d discover that subscribing for auto payments of debts helps you up-to-date with the bill deadlines. In that way, you’re prevented from the impact of late payments on your score.

2. Ensure your credit utilization is low

Don’t borrow in excess relative to the overall sum of your credits at hand. A suggestion to bring down your credit utilization as low as possible is to address just a single account at once, then make payment.

Case in point, with your card; try to make a payment above the lower limit amount to pay. Believe me; if you’re persistent well enough this way for months, you will notice an improvement in your credit utilization. After, you’ll be charged a lower interest rate.

3. Ensure your debt is as low as possible

Don’t make a habit of the debt amount you have with your cards. If you do so, you risk reaching the highest limit of your credits at hand. Not just that, creditors could rate your chances of defaulting on a loan to be so high.

4. Try not to deactivate old credit accounts

If you eventually sweat blood to pay the full debt amount on a card. Most likely, many would resort to damaging the card or be swayed to deactivate the account.

However, know that such a decision could negatively affect your score by reducing your reports and then decreasing the credits at hand. If you pay the full debt amount on a card in full, don’t think of deactivating the account—it doesn’t matter whether you use it.

5. Consider diversifying your credit categories. Make it a good variety

A consumer’s credit use is meant to take after a meal with several dishes, with a good random sample of different kinds of credits in the combination. Ensure your best to consider various cards, such as educational loans for students, auto loans, and home loans, including different kinds of credits.

That proves to the creditors your capacity to handle different loan types.

Before it’s late, know the risks of using credits?

Credits is a plus, provided you can handle it responsibly; however, that doesn’t mean there’s no risk involved.

If you mess up with your credits, you cause harm to yourself. Therefore, you bring about a terrible mishap for yourself and possibly maintain this miserable condition for a long time. Different aspects of one’s life may be affected. It could be not having sufficient money to pay for kids’ school fees or provide for post-work years, not to mention.

With the advantage of the credits, that alone can make you scale higher than what your funds permit you to.

For example, when you use credits to purchase items beyond what you can pay, you can’t notice progress for your score with the debts. Sometimes, you’d find it hard to continue and possibly pressured to submit for bankruptcy.

Make smart use of credits.

You can achieve a lot; likewise, you may end up in financial hardship if you abuse the privilege.

More horribly, before you know it, your credit history is full of negative information because your scores have dropped.

You can prevent these credits mishaps once you know the way credit serves; also what factors affect the credit score.