Secured credit cards list: 5 Pros and Cons to know

Introduction

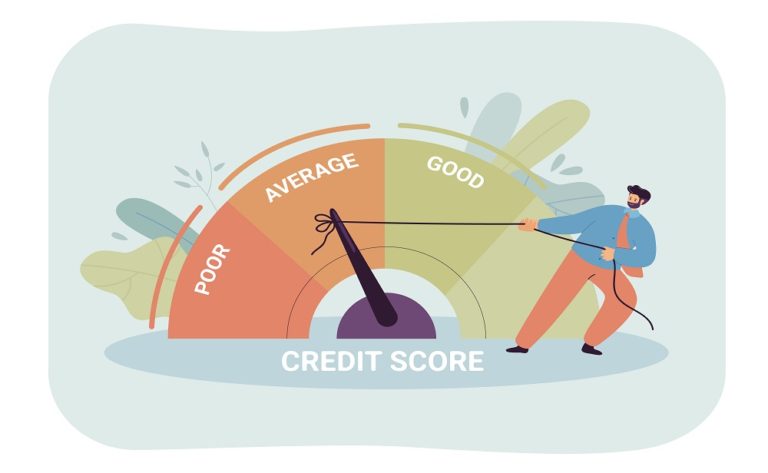

Certainly, anyone will feel unhappy with their credit score dropping over time, but the good news is you can increase the score with secured credit cards list in this article.

So, we suggest you make amends with any from the Secured credit cards list.

Besides, a secured credit card can accumulate a credit report starting from nothing (a fresh start).

One of the best ways to develop and increase credit is through Secured credit cards lists. Credit cards are effective measures for credit build-up, though they have disadvantages.

If you’re new to credit and experiencing poor credit, a secured credit card is appropriate for use. Therefore, if your credit score is satisfactory, you shouldn’t think of using secured credit, do away with it.

The secured credit cards list also has its issues, including increased interest and yearly charges.

Now, we’d examine the pros and cons of secured credit cards.

Secured credit card means what?

A secured credit card allows users to load in advance payment or security deposit when they purchase the card or top-up to the account after registering for the card.

The money topped into the account is a security deposit or collateral that sets a secured card apart from the usual credit card (not secure, such as Blaze MasterCard).

Assuming a customer pays his money owed in line with the agreement, he saves the deposit. However, if he can’t repay the money owed, the credit card business receives the cash.

On the contrary, the usual credit cards are ” not secure,” which means the card has no collateral backing or “no security deposit,” like an auto loan or home loan. The creditor may decide to have the building or car back if you can’t complete your dues payments with those accounts.

If you have Poor credit, check the Top Secured Transaction Credit Cards.

As contained in many terms for a secured credit card, the deposit a customer makes or advance payment will be the same as their borrowing capacity. For instance, let’s say you deposit $500; you’d be able to only ask for such a huge amount on your card.

Since secured credit cards are thought-through as an avenue to boost a customer’s credit. As a result, a few secured cards permit to convert secured cards to the usual “not secure” credit card later.

Secured credit cards list of 2022

Check out the Secured credit cards list of 2022 as follows;

- Citi® Secured Mastercard®

- Bank of America® Unlimited Cash Rewards

- Bank of America® Customized Cash Rewards

- Navy FCU nRewards®

- Discover it®

- First Progress Platinum Select Mastercard®

The Pros and Cons of Secured Credit Cards list

5 Pros to appreciate secured credit cards list

With Secured credit cards, you stand to enjoy several rewards.

You may plan to start, improve or rehab your credit; check the below five means a secured card could prove useful.

1. The requirements are straightforward

To get a loan, bear in mind that you need a commendation. In other words, you need good financial standing to access credit.

Suppose your credit report is all over with negative items or you don’t have enough credit report. In that case, you could not be able to decide what’s responsible for the situation.

There’s no way you could think of starting your credit history or rebuilding it when you are not eligible for credit at first.

Secured credit cards are particularly facilitated for customers with poor or low credit.

At one time, you have a low credit score or don’t have enough credit reports as required. There is every chance that you have already been denied credit card access. However, a secured card can greatly assist in improving your credit score.

2. There’s no fear of a Debt collector

If you no longer make payments with the usual credit card. The card enterprise directs you to any debt collector responsible for checking or inquiring into your credit report and causes you to be prevented from any subsequent credit.

Nevertheless, if you resort to a secured card, the lender only holds the deposit. Therefore, he doesn’t need to employ a collection agency.

Remember: With that, it doesn’t stop whichever late payments from appearing on your credit history.

3. A few cards get you a commission

Determined by the samples of secured credit card a customer requests, there’s a possibility such individual receive commission or get a percentage on top of his money paid in.

Before registering a secured card, seek information from your creditor on whether the account you’re about to open can get you interest. You are most likely not to receive the rate in large amounts; however, it’s not bad. The rate is worthwhile and significant to consider.

4. Establish a good credit record

Many establishments charged with the responsibility for secured credit cards tell of your promptness to bill payments to the credit report agency. Your prompt bill payments indicate how reliable you are and can increase your chances of getting credits from subsequent lenders.

5. Have a right to the usual Credit card

You may imagine a secured credit card as a credit card sample with compensation or support.

When you pay your bills at the right time and do all that’s necessary, you could probably go further ahead to the usual credit card after some time.

When you have achieved a good credit record, you’d have a right to more lines of credit and higher interest.

5 Cons to devalue secured credit cards list

Know the disadvantages of using Secured credit cards before applying.

1. Requires Security deposit/advance payment

The advance payment condition made compulsory for using Secured credit cards is the No. 1 disadvantage. The Deposit value is not the same from one creditor to the other. At the same time, many cards stipulate some hundred dollars’ payment.

However, a few secured cards request at least $1,000; some of the cards impose very high-security deposit conditions.

If you are on allocation, you can find it grueling put forward such a huge amount of money as an advance.

A couple of creditors for secured credit cards allow you to share the money deposited to payments. It could assist, provided you’re on a spending plan that lowers the sum of money to spend.

2. Charges and Tariffs

Several secured credit cards list you may see around are not made the same. Therefore, try to find the yearly charges above average for registration and other tariffs.

Be very attentive to the clause controlling the use of credit cards to ascertain you don’t pay overmuch in different charges and tariffs.

3. A very high interests

The secured credit cards list is aimed at borrowers with bad credit. Therefore, it’s prevalent for these firms to bring on conditions that are not friendly.

As an illustration, a few secured cards come with a better (APR) annual percentage rate, contrary to the usual credit cards.

4. The Borrowing capacity is little

Many secured credit cards list restrict a customer’s credit at hand to his security deposit.

You deposit $300 in advance; for instance, you’d only access at most $300 with the card.

That’s why many individuals are eager to convert to an unsecured credit card immediately after they can achieve a good banking record.

5. Do not consider the “Convert” feature

This disadvantage of the “no convert” feature, in particular, does not affect all secured cards. Therefore, carry out thorough research to avoid that.

There are a few secured credit cards with which the creditor allows the option to change to an unsecured credit card after some time.

Take note: Not all creditors enable this “convert function.” No doubt about that.

You can have your card not have the “convert” feature. You only need to follow up with the request and eligibility procedures afresh after making up your mind to change to a regular credit card.

A step-by-step guide to applying secured credit cards list?

A secured credit card proves to subsequent lenders that a customer is of little possibility for credit access.

You must use a secured card as the best way to do this.

Try to complete some buy requests. The secured credit card is there, in essence, to prove that a customer is reliable. Ensure to use the secured credit card moderately by completing a low amount of buy requests that you’d be able to settle every month with no sweat.

Settle all your debts complete monthly. The secured credit cards list has increased interest rates contrary to regular cards; therefore, it is most appropriate to settle your monthly debts.

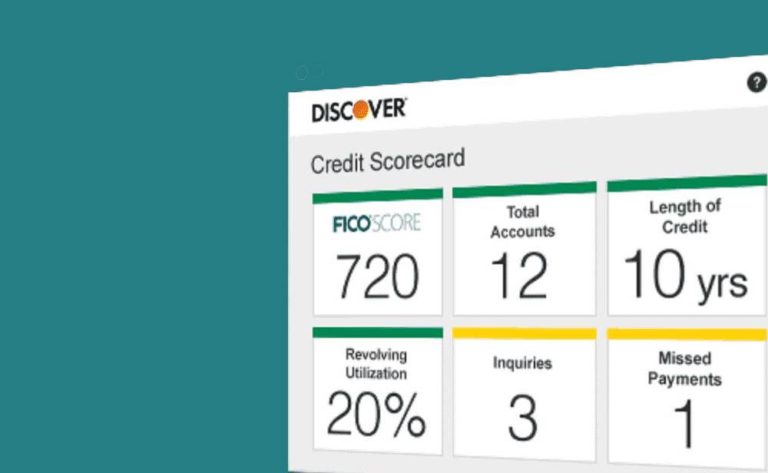

Keep an eye out for credit scores. While the month’s count, keep track of your credit score. And while you’re prompt with payments, the score rises. With that, you could upgrade to a regular credit card.

Comparison check on prepaid debit cards and Secured credit cards

Do you have a target for a secured credit card? In that case, there’s the possibility you’d be curious about the way a prepaid debit card is related to a secured card. On the surface, both credit cards look similar.

Moreover, a prepaid debit card is not the same as a secured card.

If you’re using a prepaid card, you send funds to the card with your money in advance. It implies the creditor does not increase the credit—neither does he present bills paid to the credit reporting agency.

While you make an effort to start or rehab credit, consider using the secured credit card as it is best appropriate.

Is the secured credit cards list better to use?

Now, you can tell the pros and cons of secured credit cards.

Are you a novice to credit or trying your best to improve from a poor credit record? Can a secured credit card significantly assist?

If you pay your bills when expected and handle your credit card reliably, you should have your credit score increase in the next few days.

Many individuals who borrow could notice an increase in some months; it’s often viable to transition to a standard credit card after a year.