How to dispute error on credit report easily: Follow 2 simple process

Introduction

Your credit report is full of errors. Can’t sleep? In this post, you’d learn how to dispute error on credit report.

Wait a minute! Are you aware that the Federal Trade Commission conducted research some years back?

Moreover, the research outcome found that over 1 out of 5 US Citizens found errors in their credit history. That kind of error makes a borrower appear his chances to default on a loan are higher than what they come off as in the real sense.

Before you consider removing collections, charge-offs (write-offs), and late payments of your credit report to improve credit, you should be familiar with the right way to dispute these errors with the credit reporting agencies.

As you can lay hands on prints of your credit reports for free, check carefully for inaccuracies; follow the two routes below to dispute error on credit report.

- Speak to the credit reporting agency to dispute the negative information. Write a memo (see a sample under) and address it to the credit reporting agency responsible for reporting the negative information.

- Meet with the creditor to dispute the negative information. Once the credit reporting agency confirms the negative information, you should write a memo (see a sample under) addressing it to the creditor, asking them to check it.

Next, I’d run over the above process one after the other as listed.

First Procedure: Speak to the credit reporting agency to dispute the negative information

Don’t forget: some creditors, including businesses, refuse to provide an account of the item to every one of the three credit reporting agencies, but a number of them do that. Therefore, you may notice inaccurate negative information on just one of your credit reports. However, other reports may not have it.

Therefore, remember to dispute the negative information being discussed only along with the credit reporting agencies that the information shows.

Specifically, you may notice a late payment on your credit card appearing on that Experian credit history; moreover, you can’t see it on TransUnion or Equifax. You’re only to see Experian delete the information.

Does it seem reasonable?

At this point, I’d write a memo so you can see. But If you check online, it’s stocked with countless letters that even a layperson can follow the pattern. However, we prefer the sample letter provided by the Federal Trade Commission.

A Template letter to dispute error on credit report

[Customer’s Name]

[Residence location]

[ Town, State, Postal Code]

[Date]

Critics Section

[Name of Business]

[Business Address]

[Town, State, Postal Code]

Dear Madam or Sir:

I draft this memo to disagree with my account’s item below. I got a print of reports, though it’s attached to the letter. And, I indicate a circle specifically to the information disagreed by me.

The information [describe information(s) disagreed by either tax court or moneylenders, mark out the sample of information, like credit account.). Is [not complete or incorrect] that [Indicate the actual item that’s not complete or incorrect; also state the reason]. I now ask to delete the information [or ask for some other change] to adjust the item.

Attached with the letter are duplicates of [only write if necessary and identify the attached files like court papers, banking history] to prove the case in question. Kindly look again into this [these]issue[s] and[put right or remove] the disagreed information[s] soon.

Sincerely,

Name of writer

Attachments: [Itemize the documents you attached.]

Check below crucial points to not forget for your memo and query:

- Remember to forward the memo using the correct mail (You can give tangible evidence that the agency got the letter).

- Attach duplicates of your credit history added to the disagreed information itemized.

- Insert additional documents, like court papers and banking history.

- Legally, the credit reporting agencies must consider your plea to investigate the matter.

- The credit reporting agencies may not validate the negative information to be correct. In that case, the credit bureau should remove the item.

- The credit reporting agencies are to reply to your query in less than 30 days.

- In the feedback, the bureau should indicate that a) they already removed the negative information as requested or b) they confirmed it to be correct.

It’s as simple as that how to dispute error on credit report.

Perhaps the credit reporting agencies insist they have confirmed the information contained in the dispute. Keep calm—in most cases, that’s always their response. Now, proceed to the other procedure.

Second Procedure: Meet with the creditor to dispute the negative information

Once the reply from the credit reporting agency is that the negative information discussed is “confirmed,” you are to forward a different letter. But, you address it to any of the creditors or the firm—for example, credit card establishments.

The trick with this procedure is to shift the responsibility to verify to the creditor. It’s their responsibility to look around and make available the relevant files to justify the borrower was late when paying his bills or whatever the problem may be.

Once the creditor refuses to act by the letter, they have no choice but to remove the negative information on the report.

For the memo samples, the Federal Trade Commission prepares a memo sample to use; likewise, suggest submitting through an approved mail:

A Template letter to dispute error on credit report

[Customer’s Name]

[Residence location]

[ Town, State, Postal Code]

[Date]

Critics Section

[Name of Business]

[Business Address]

[Town, State, Postal Code]

I write this letter to disagree with the below items your firm delivered to [write the credit bureau name here that its report contains the incorrect item]. And, I indicate a circle specifically to the information disagreed by me.

This information [identify information(s) disagreed in the section, like credit account, account number. And, account details, probably you specify some other ways to find the account details.] is [not complete or incorrect] being that [Indicate the actual item that’s not complete or incorrect; also state the reason]. I now ask to delete the information [or ask for some other change] to adjust the item.

Attached with the letter are prints of [only write if necessary and identify the attached files like court papers, banking history] to prove the case in question. Kindly look again into this [these]issue[s] and contact the national credit reporting firms that you sent the items to that they [put right or remove] the disagreed information[s] soon.

Sincerely,

Name of writer

Attachments: [Itemize the documents you attached.]

Check below crucial points to not forget for your memo and query:

- By law, the creditor should reply to the letter—often 30-45 days.

- Make sure you don’t declare you’re wrong in the memo. Follow the sample letter; don’t discuss your life affairs in the letter “case” —you’d end up regretting it.

- The creditor’s response will indicate they either remove the negative item. Another option they tell it’s true and error-free.

You may be fortunate the creditor accepts to remove the negative information or they declare it’s true. Maybe they wouldn’t like to stress looking for all files, or they don’t want to lose you as a regular client.

The creditor should inform the credit reporting agency to amend the negative item.

If creditors refuse to delete the negative information, What follows?

Suppose the credit reporting agencies or moneylenders couldn’t or are not ready to confirm the negative information on the report in that scenario. In that case, it’s removed from the report.

Now, after looking into the item, What follows? Also, either the moneylender or credit reporting agency insists the damaging information is correct?

You have few options to make; however, follow these measures below:

- Feel free to request the credit reporting agency to include a disclosure narrating the portion of your dispute.

- Another point is to send a statement of dissatisfaction with the Consumer Financial Protection Board supposing that you felt they mistreat you. For instance, they didn’t attend to the dispute fast or made no effort to listen to the mistake on the report.

Up to this point, you should know how to dispute error on credit report.

Frequent mistakes on credit reports

Before you know how to dispute error on credit report, you should know what to do to dispute inaccuracy in your report; however, which information to dispute?

A number of the frequent mistakes on credit reports could badly impact a credit score you wouldn’t know. The faster you correct the errors, the more favorable your credit and the borrowing conditions are.

Wrong personal data

Possibly, incorrect personal data is more frequent than mistakes with credit reports.

Mind that you check the items carefully, such as telephone, name, social security number, location, and job details.

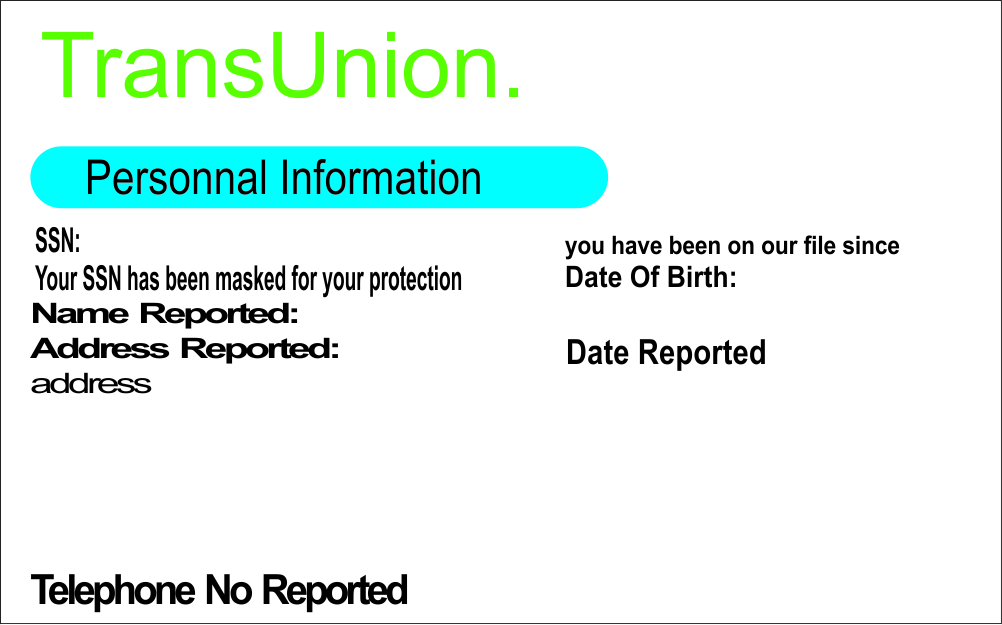

Take a look at how the part appears with TransUnion’s credit report as a case study:

In some cases, individuals bearing the same names could be recorded, and their credit may impact yours. Though it’s not common; however, it does come up.

Remember, you can notice a few spelling errors writing your name. If the creditor sends in your details incorrectly, the situation may come up once. Moreover, it’s nothing to worry about, so long as your credit does not impact the other individual’s name.

Besides, you probably notice your location is not the current one. Sometimes, if it’s been a while, you make activities with your credit; most likely, the item might not refresh. Never bother about it so long as all the locations specified are where you’ve lived in the past.

Counterfeit and Two Identical accounts

Sometimes, accounts may be registered twice or beyond (two duplicate accounts). Even though what you’re having is not negative information, it could negatively affect someone’s credit since it increases your debt twice or more. Therefore it’s that serious about being conscious of it.

Fake accounts are another serious issue and are very disadvantageous to consumers’ credit.

Over and over, an identity fraudster sneaks anybody’s data to sign-up for credit card accounts with their name. After such fellows refuse to make timely payments; as a result, it hurt the actual owner of the credit misappropriated. In 2016, over 15M US citizens were victimized by identity fraudsters.

Your attention will be on the accounts you no longer know about or can’t recall when you open.

The actual essence of FACTA is to address the fraudulent act. It formalizes credit reporting agencies to enable customers to receive credit reports without paying any fee. Likewise, that’s the most appropriate way to prevent identity fraudsters, provided you stay in control.

Meanwhile, you could register for monitoring companies on credit activities. It strengthens your security level against fraud. I’d suggest you consider Experian ID Protection or LifeLock if you noticed someone infringed on your access or have at one time experienced identity fraud.

Information No longer valid; How to dispute error on credit report

Are you aware some items should disappear off your credit reports by themselves after some years’ count?

In the chart below are several kinds of information on a credit report and the length of time the items could remain on the credit report:

| Information on a Credit report | Number of years |

| Bankruptcy | 7 years ( Chapter 13 Bankruptcy ) – 10 years ( Chapter 7 Bankruptcy ) |

| Foreclosures | Seven years begin to count from the day the consumer puts in for Foreclosure. |

| Judgments | Generally, it’s 5 – 10 years, determined by the provinces. |

| Late Payments | Seven years |

| Evictions | As determined by the Landlord’s decision, it’s attended to as judgments or collections. |

| Hard pulls | Two years ( despite having it on the report for two years) affects someone’s credit for only one year. |

| Tax claims | Seven years, provided that it’s funded |

| Charge-offs | 7 years |

| Collections | 7 years |

Late payments should disappear once seven years have passed. Therefore, if you see a write-off or uncollectable bill on your credit history for more than seven years, request to delete such.

And if you can’t remove it yourself, consult a credit repair business for assistance. Also, Follow this link on how to select the best credit repair company.

What’s next?

Moreover, you should know about the items to dispute on a credit report and how to dispute error on credit report. After you understand that well enough, the next thing is repairing your credit: using a refund strategy to settle up overdue accounts.