Where get your free credit report very fast: 5 steps

Introduction

Looking for Where get your free credit report? You’re in the right place. Sit back and read to the end.

You can’t avoid opening an account; send part of your personal details to very few websites if you’re ready to get your free credit report score. Nevertheless, don’t let that make you panic; the whole procedure is nothing to it. In this article, we’d guide you carefully through the process.

Aside from you’d know where to get your free credit report and how to get a free credit report, the articles emphasize the best website to get free credit report. And that is AnnualCreditReport.com and Credit Karma.

Where get your free credit report? The two websites to get your free credit report are discussed below;

Credit Karma

I can’t view my credit history? If you’re looking to get a copy of your credit report from a website that’s easy to use, think of Credit Karma. Unfortunately, the site does not allow the opportunity to Experian’s record.

AnnualCreditReport.com

AnnualCreditReport.com is one of the best place to get a free credit report. Navigate to TransUnion, Experian, Equifax to get a copy of your credit report annually. Though there are other services preferable to AnnualCreditReport.com when it comes to the easiest and most helpful option, all the same, we can beat our chest for AnnualCreditReport.com; very authentic and legit.

This article emphasizes using AnnualCreditReport.com to Get Free Credit Report altogether; we’d also discuss how to use Credit Karma, but not so deep.

It’s as simple as ABC to get free credit reports through AnnualCreditReport.com.

- The first thing is to present a couple of your data to the website “AnnualCreditReport.com”

- Determine whether you’d like to get records from the three credit agencies, or you only prefer 1 or 2.

- Verify other personal details with these credit agencies

- When you decide to repair your credit, one crucial thing is lay hands on your credit report.

Let’s bring it on!

Where get your free credit report via AnnualCreditReport.com: 5 Steps

Are you aware of your rightful access to get a copy of your credit reports through these three credit agencies, just once annually?

That’s possible because of (FACTA) of 2003, “Fair and Accurate Credit Transactions Act.” To some extent, the statute is arranged to assist customers in getting familiar with the stuff creditors observe. Also, to avoid scams on credit, impersonations for stealing by enabling a user to catch a glimpse of credit limits they had not use.

Now to the question, where get your free credit report? The most appropriate method to get a free credit report is AnnualCreditReport.com. URL. At this point, we’d guide you carefully through the process one after the other.

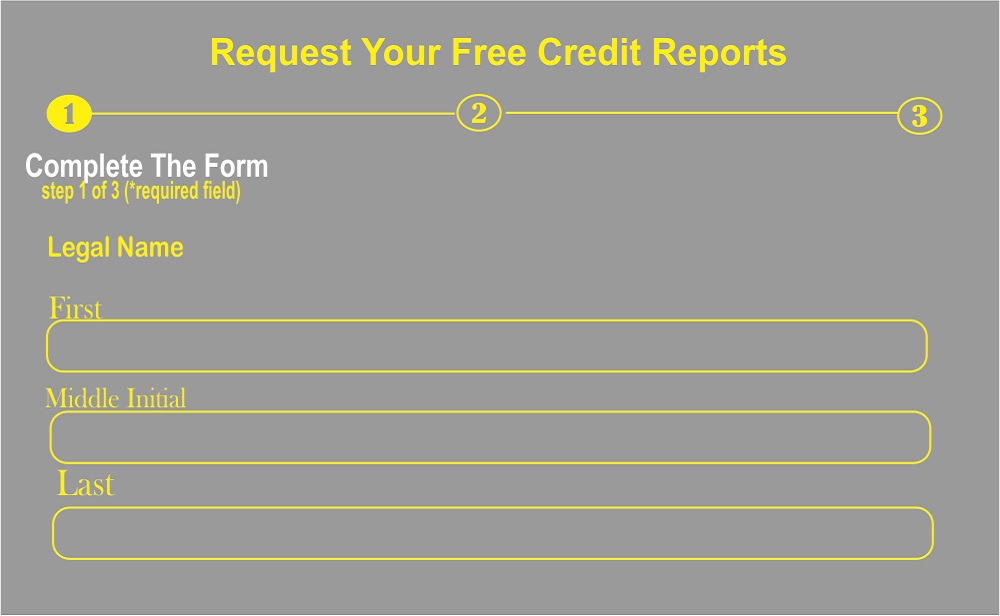

Procedure 1: Complete the blank with your personal data’s

If you’re using AnnualCreditReport.com, the site requires you to authenticate information on your profile, including name before you have your credit reports. Therefore to start with, you should proceed to the sign-up page for the service, then complete the blank with your details. It’s something similar to what you can see below;

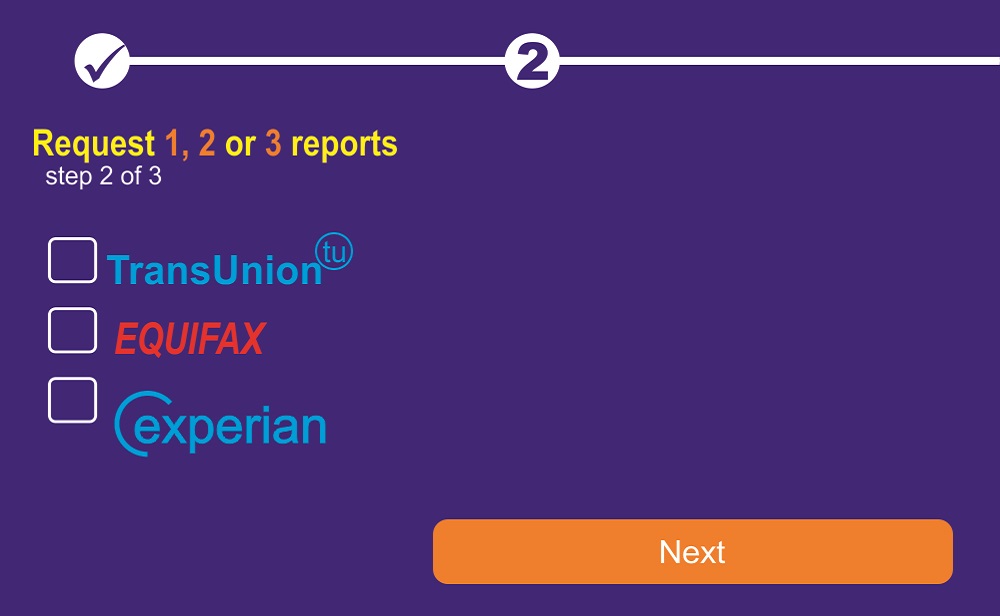

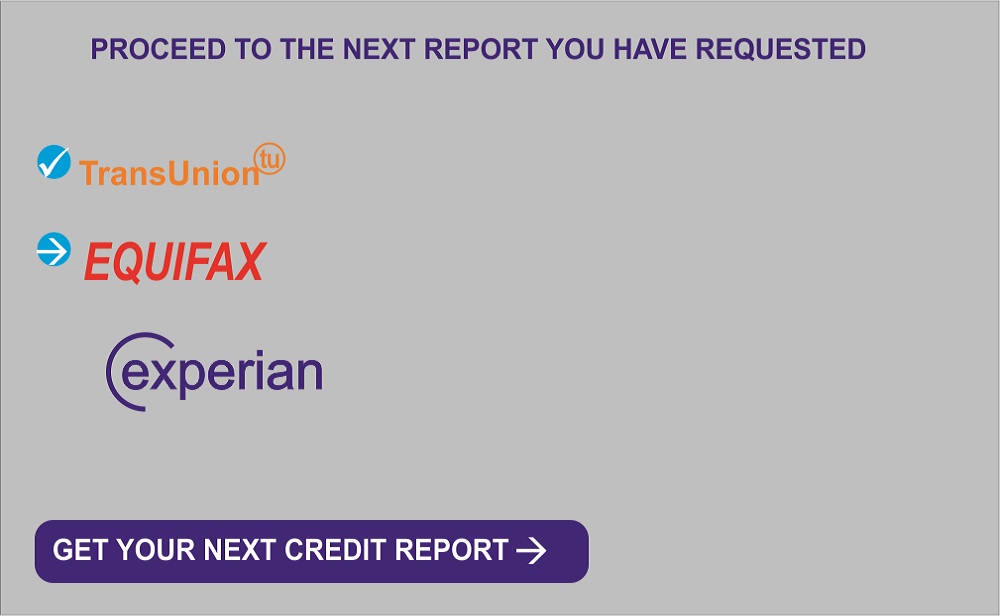

Procedure 2: Choose whether to have all your credit reports immediately, or to get only 1 or 2 reports.

AnnualCreditReport grants the opportunity to get your free credit report score through whichever of the credit agencies. You can also use the entire three at your discretion.

Remember: Annually, you can get a free copy through Experian, Equifax, TransUnion separately. However, you don’t need to pick all three at once.

You may decide to share the three all through the year, and that’s precisely what Scott Henderson put to practice. Would you like to know? Continue reading.

“Henderson arrange for an alarm to call his attention to see his credit report the first day of the New year with TransUnion, then he checks with Equifax the first day in May, later checks with Experian the first day in September,” mentioned by Henderson.

You may pick and retrieve the three altogether; you may share the three as another option.

We suggest you pick and retrieve the whole three reports together at the same time if you are preparing to buy something worth a whopping amount, like a Mansion, car. Our reason for this is that you are likely to ascertain that all the three are correct before you are given an estimate for an interest rate or loan.

On the other hand, if what you intend to buy is of low amount, you’d better share the three reports—in this way, it enables you to always pay attention to the reports all around the year.

Conclude, then toggle on the “Next” icon.

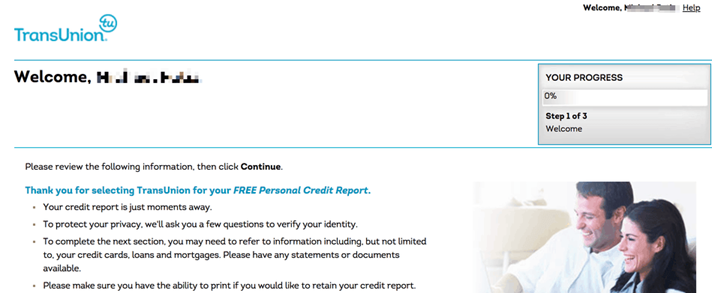

Procedure 3: Reach the credit agencies to verify your data’s with them

If you flip to the other page, you’d need to verify one or two of more personal data with any credit agencies you initially picked.

The system requires you to verify your data with TransUnion on this page.

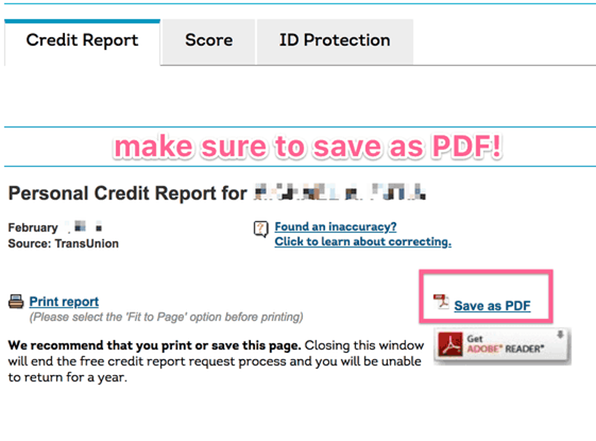

Procedure 4: Scan, then save the credit report!

The following page is where you see your credit report for free! Pretty fantastic!

Keep in mind: ascertain to keep the report in PDF format to enable you to reflect on it afterward; also, save it for years to come. Supposing that you shut down the page and you’re yet to save the report, there’s a tendency you may not have the report anymore. So, be careful while you load the page.

From the description under, it shows the point with which you can “Save as PDF”:

If you want to save, we suggest you do that to stores, for instance, Dropbox, Google Drive, or any other safe point. Thus, you’d be able to access the report when needed. As simple as that!

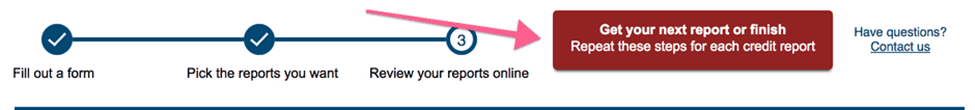

Procedure 5: Proceed to the other credit report

You conclude to get a free report by 2 or 3 of the credit agencies; tap the red control to proceed and get another credit report next.

The user had retrieved the credit report through TransUnion from the illustration above. Presently he had to undergo the same procedures to receive the Experian & Equifax records, specifically verify some other identifying information necessary.

Subsequently, the user had the credit report for free through all three credit agencies.

What’s the number of free credit reports to access annually?

FACTA stipulates any customer’s rightful access to get a credit report for free by TransUnion, Experian, Equifax annually.

However, there are some conditions to get one extra credit report:

- However, assuming you are yet to gain employment, though intend putting in an application for jobs in the coming 60 days.

- If you get good fortune

- If you have a feeling to suffer credit scam

- In the case that you are disallowed credit or particular loan conditions that are due to risk

We’d expound further on the last option from the list mentioned above

Once you are disallowed credit, the creditor has to forward a message to you presenting which conditions were considered while resolving your denial for credit. Also, it thus includes the contact details of the credit agency that was reported to have the information. Possibly, you reach them on the phone to grant you a credit report for free through mail.

Now, let’s discuss with Credit Karma…

How to get a free credit report via Credit Karma

Hitherto, just as AnnualCreditReport.com is the most appropriate method to get free credit reports, we decided not to discuss much on Credit Karma as the agency provide decent added features aside from granting access to credit reports. For instance, the fact that you could see the reports whenever you like and even more than one time annually is motivating.

However, a very important aspect to note: Credit Karma provides your credit reports for free through Equifax TransUnion. Meanwhile, Experian is out of the option.

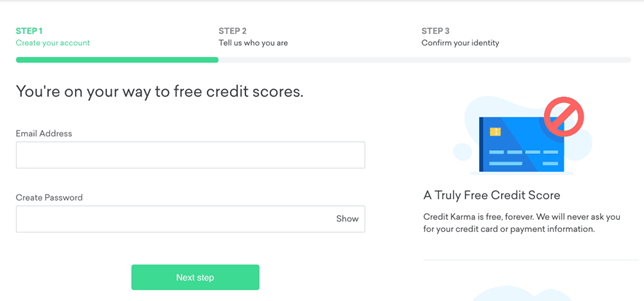

Credit Karma’s method: How to register

If you’re ready to have a profile with Credit Karma, follow the link, then sign-up for an account for free.

Immediately you have completed the required personal details in the blank, and authenticate the information on your profile—don’t forget the services want to be sure you are not faking your personal information and identity before releasing any confidential data to you. Example of the information is passwords—you can see that on your profile.

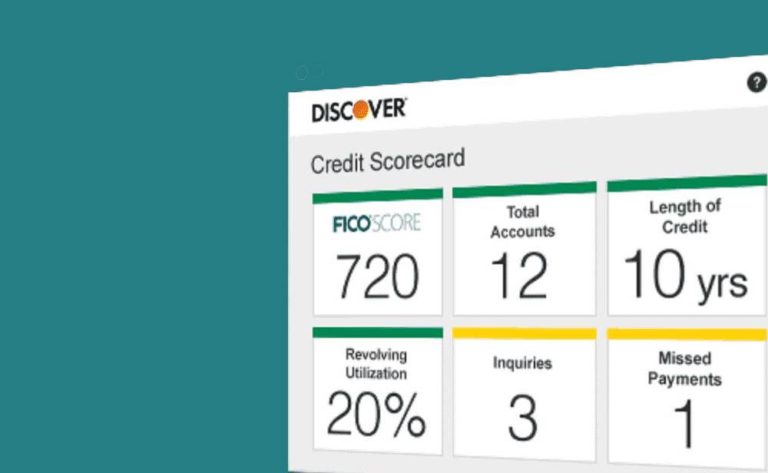

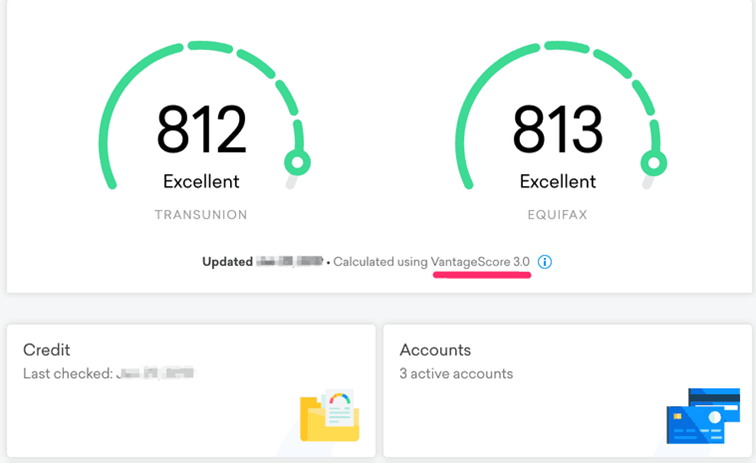

Typical Profile for Credit Karma

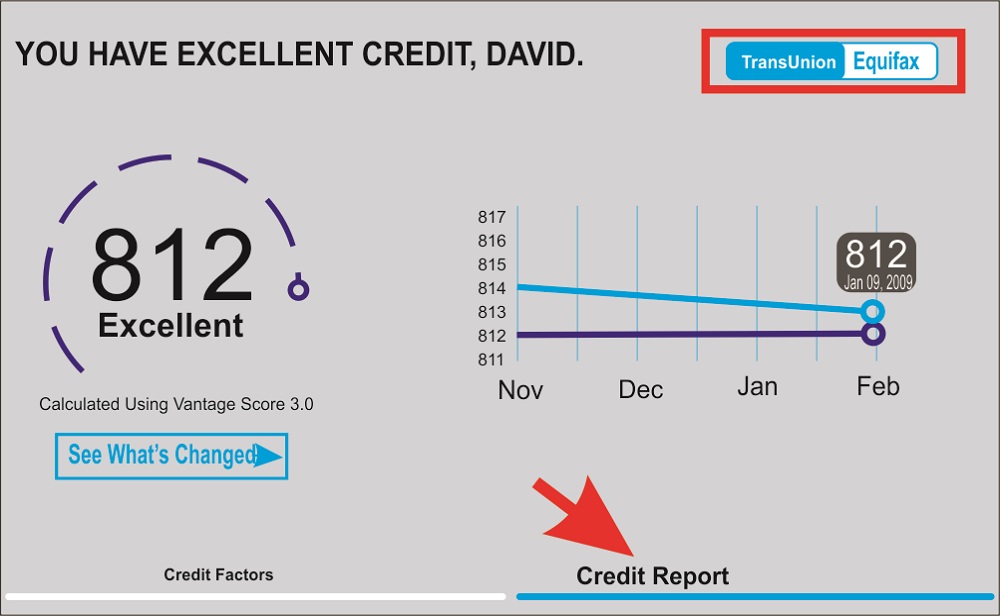

That’s a typical profile with Credit Karma; it displays the VantageScore (basically in competition to FICO marks) by either Equifax or TransUnion.

After you tap the TransUnion points, this then directs you to another fresh page that displays a 4-side print of the VantageScore. Besides, you can switch pages from Equifax to TransUnion records. Likewise, it allows you to tap directly into your current credit report.

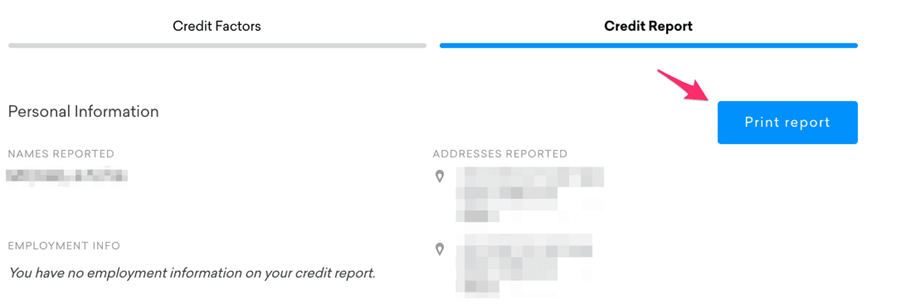

How to access your credit report?

After you tap the “Credit Report” link, you will see the credit report.

Besides, you have the option to print the record in PDF; that’s what we suggest you do.

There’s nothing more to add as to that!

Where get your free credit report? By now, you should be able to get copies of credit reports for free by TransUnion, Experian, and Equifax using AnnualCreditReport.com.

15 Best Banks not on Chexsystems

Furthermore, the article explains the easy steps to get your free credit report score by TransUnion and Equifax using Credit Karma. You’d be able to see your reports whenever you like, not only one time annually.

After you get your credit reports for free and it’s available for use, you can proceed to another process. That is analyzing and studying the credit report to ensure you understand all that’s in there.

Conclusion

Getting your free credit report is not as hard as you think. Up to this point, you should know how to get a free credit report yourself.