Be cautious of these 5 Factors impacting credit score

Introduction

While you do your best for a credit repair, you must be familiar with the various factors impacting credit score.

Fixing a bad credit score with no idea of the five factors impacting credit score is just like trying to win a game. Moreover, you’re completely strange about all the game’s procedures and fundamentals. When you know the cause responsible for a problem, you can easily handle the situation appropriately for repairs.

Sure, you can go ahead to search on Google how to repair your bad credit; regardless of what you find, you still need to know 5 Factors impacting Credit Score. But, which are factors that affect your credit score? They are Payment History, Credit variety, Credit Pulls, Credit utilization, Age of Credit. The article expound further on each of these in detail.

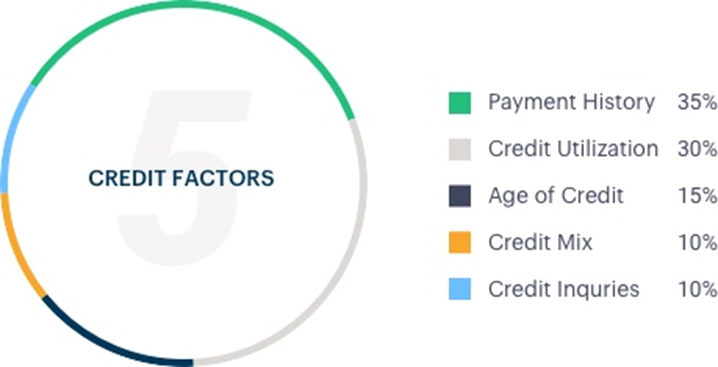

As any scoring criterion employs a somewhat separate method, bear in mind that factors affecting FICO® score have the five parameters itemized in the table under;

FICO® score Has these five factors impacting credit score

| Summary | Factors impacting credit score (Their weight to affecting the score on a percentage level) |

| Banking record: Contribute 35% | User’s promptness in paying bills at the right time: |

| Credit utilization: Contribute 30% | It’s the credit amount ready for use at the very minute. |

| Credit report: Contribute 15%The duration till date you use the creditCredit variety: Contribute 10%The number of various debts currently in useNew credit: Contribute 10%The frequency at which you place requests for new credit. |

Are you unclear about the information above and their respective meanings?

Sit back! The article discusses all five factors impacting credit score. It puts up several helpful tips to maximize each element that profits you.

You can only think to start engaging in practical procedures that should repair your credit score successfully after you understand the five factors pretty well. Likewise, the way they affect credit score.

Know about 5 factors impacting credit score in-depth and how they affect your score

#1. Banking record: 35% Impact level on the credit score

A banking record or Payment history is the number one among the top three factors that affect your credit score. So, you should pay serious attention to this.

The crucial aspect of a person’s credit score is paying up expenses due constantly without delay, with an impact level of 35% on the FICO® score.

Scott Henderson “Popularly known credit professional expressed this.” Assuming you failed to pay up just one money owed, this is very likely to cause a significant risk compared to any other factor.

What makes FICO® focus attention on the user’s banking record considerably?

Literarily, suppose you had a reflection of this. In that case, it seems right reasonably: Assuming Mr. A gave a loan to Mr. B. of an amount, and the agreement between both parties is that Mr. B. is to return the money complete at the right time, paid several months, in that case, you just proved how trustworthy and reliable you can sign-up for credit.

On the other hand, did you not return the owed money on time or pay a part payment? As a result, you just proved yourself to creditors down the line that they should avoid you as you’re not likely to pay back loans. Simply put, you fall into those whose chances to get a loan are slim.

Banking record is of utmost importance. Good! What can you do most favourably to add to the quota your “banking record” contributes to the credit score?

Helpful Tips: What to do

Make a habit of settling up money owed in total amount—overdrafts, credit cards, and mortgages—promptly every month.

You need to be aware that your total loans can appear as an element of your banking records and the loans you pay bits by bits and that which is revolving. Meanwhile, any of the loans is estimated alike. That is to say, any of your bills on credit cards you couldn’t pay (maybe you did see such on time) counts similar to that of a mortgage.

#2. Free credit utilization: 30% impact level on a credit score

A customer’s “credit utilization” is another crucial factors impacting credit score. That is the value of the credit you use now— with an impact up to 30% of the FICO® score.

Generally, you hit a high spot of your available credit amount (credit limits) time and time again. it reflects how you manage your bills; best put “not responsibly.” Likewise, It’s a red flag to creditors that you’re too risky and neither fit for a credit.

Thus, a perfect scale for credit utilization is.

Do your best to consider approximately 30% for credit utilization. Moreover, the 30% here is that you will use only 30% of the amount at hand and all the available credit amounts.

A Case in point

For instance, a user has a credit card brand-named Chase of about $6,000 credit lines another Amex card of $4,000 credit lines. However, while the amount left on the Chase card is $2,500, likewise, the Amex card has a $1,500 balance.

With this situation, such a user’s credit utilization is 40%, meaning it’s 10% above the required 30% scale.

Helpful tips: What to do

“Assuming the owners of these cards have a high amount left in the accounts respectively. And, one of the fastest manipulations to better your credit scores is to pay the balance down, the idea established by Louis DeNicola, a credit professional.

In addition, bear in mind that the figure varies whenever you pay your bills or increase the credit limits. As a result, that’s essential information to focus attention on your credit report.

#3. Credit report: 15% Impact level on credit score

Age of Credit or Credit report is another factors affecting credit score. The duration you keep to using the credit accounts for like 15% of the overall FICO® score.

Meanwhile, what makes FICO®, including creditors, look out for the span a user keeps using credit?

A Suggestion to pick Best Credit Repair agency

Are you experiencing a short credit report—if you claim the period you’ve had a credit card is only half a year? This way, creditors will have difficulties determining whether you are a fit as to the risk aspect to grant you credit overdraft at a lesser interest.

Can you boost the “credit record” included in your credit score? See What it takes!

Sadly, we couldn’t manipulate you a “trick,” though time will tell, maybe in the future.

Moreover, while your account has had a positive banking record over a long time, this increases with your score.

Helpful tips: What to do

Ensure to save your credit cards even though you no longer use them at the minute—while you close your accounts can lower your credit report and thus reduces the credit score.

The bright side is that you correctly make the best use of your resources. Also, maintain your credit utilization very low; it can’t take much time to rehab a perfect credit report.

#4. Introducing a variety of Credit: 10% impact level on credit score

Creditors are eager to be sure of your capacity to deal with all kinds of debt, after which getting an account of different credit varieties with a 10% Impact level on a credit score. In addition, credit variety is one of the factors impacting credit score to give rapt attention.

The “variety” of debt in contextual terms is essential if you’d be able to deal with other debt types aside from credit cards, such as auto, subsidized, and home loans.

We observed this while examining the FICO® record without paying a dime with Discover’s Credit account.

Discover then suggests being deprived of sufficient “loan milestone” affects the credit score.

A study on Credit Saint

With the situation at hand, it’s hard to provide enough valuable tips under this section. From our case, we arranged for rooms in a municipality and observed that a car is unnecessary. Therefore, we had no auto loan, neither home loan), likewise sponsorship loans for students.

It’s not best to hire a motorcar or purchase an apartment to increase your credit score from one or two points. For that reason, it is essential to consider your real-life affairs and bear in mind there’s no manipulation whatsoever to be suitable for the credit score processes.

#5. New credit: 10% impact level on credit score

The “New credit” parameter is not so confusing about the bulk of newly opened accounts, maybe in the last few days.

Suppose you register many new accounts all at once; it can reduce your FICO® record since it makes you feel a credit risk and thus increases the list of hard pulls on credit. Meanwhile, some news accounts most likely can’t affect you.

Delete Hard pulls off the credit history; read the steps.

Don’t forget it concerns only hard pulls on the credit report; soft pulls are out of it.

Check out what differentiates soft and hard pulls below? Below are a few instances:

| Hard pullsSoft pullsPlacing an order for educational loans The manager identity verification Putting in an application for a credit cardCredit card approval in advancePutting in a request for an auto loanHiring a carPutting in a claim for a home loanAuthentication of Identity by banksSigning up for a checking or savings accountFind out your separate credit score |

However, keep in mind that just hard inquiries put up in a year take a credit score in to account, then it decreases totally after two years have passed.

Helpful tips: What to do

Do not freak out while requesting six separate credit cards at once. And, such actions help for a favorable outcome and a large amount—you should only apply for new credit when you have to use it. In short, when the need arises.

Which are the factors that don’t count on a credit score?

Howbeit, we had discussed everything possible that could determine FICO® score. Just as the above-discussed factors affect your credit score, some do not affect credit score? Other things that affect your credit score are not as important; it does not count and has zero impact on the score.

The Consumer Credit Protection Act confirms there’s no way a user or his credit score is likely to be punished unfairly or disadvantaged as per the following;

- Ethnic group

- Tribe

- Relationship status

- Sex

- Religious belief

Several factors incorporate in the score arrangement; moreover, FICO® decides not to consider all these. Besides, it considers age any information concerning your job, like occupation records, monthly income, managers.

Without hesitation, creditors are probably to give much attention to the information. And it can’t manifest in the credit score.

Best Finance Companies operating without ChexSystems

When you request a home loan, the creditor is very likely to ask about your credit score and earnings. Meanwhile, a user’s salary is not in their credit score—these are two different pieces of information.

Similarly, FICO® excludes details like user’s location, promo surveys, credit checks, bank rates covered for loans, pending kid’s sponsorship arrears. Or different data not verified to illustrate how well the credit performs.

Also, you’d be lost for words to see that the credit analysis is not in the credit score.

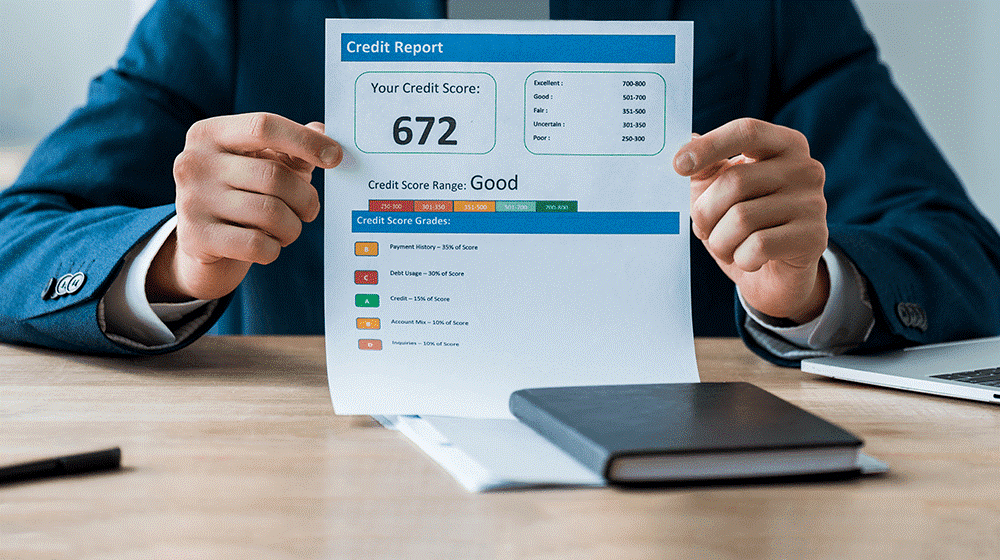

By now, you should be able to calculate your credit score. Then, proceed to another course of action to find a (free) sample of credit reports at the three prominent credit agencies.

Closing words

Factors affecting credit score are crucial to be cautious about; if you show a lackadaisical attitude toward each of the factors discussed in the article, don’t be surprised to see your score falling.

By staying positive about the factors impacting credit score, you stand a chance to increase credit score.