A simple Guide reading credit report for beginners

Introduction

It can be discouraging to read all the data, including bullet points on a credit report; however, if you could go over this Guide reading credit report to the end, you’d find it no sweat reading credit reports like a pro.

Before you can repair your bad credit or say anything about the fix, you must understand and familiarize yourself with the template to reading credit report. Not just that, you should be able to identify the items found on the report.

So, as far as disputing mistakes on a credit history is concerned, you’re provided with the basic idea to have the information’s deleted from the report.

Guide reading credit report: Basic Information categories

Look closely at the below details included in a credit reports

- Identity: Personal data

- Public data

- Credit pulls

- Debt Collector agency

- Account data

Next in this article, you’d discover the categories above one after the other, along with all information to expect.

Identity: Personal data

Before you could see any other things on a credit report, the user’s identity or personal data is the first item to spot at first glance.

These are the basic information you’re conversant with already, such as your home location, name, telephone contact, social security number, and DOB. That’s just a fraction to the Guide reading credit report.

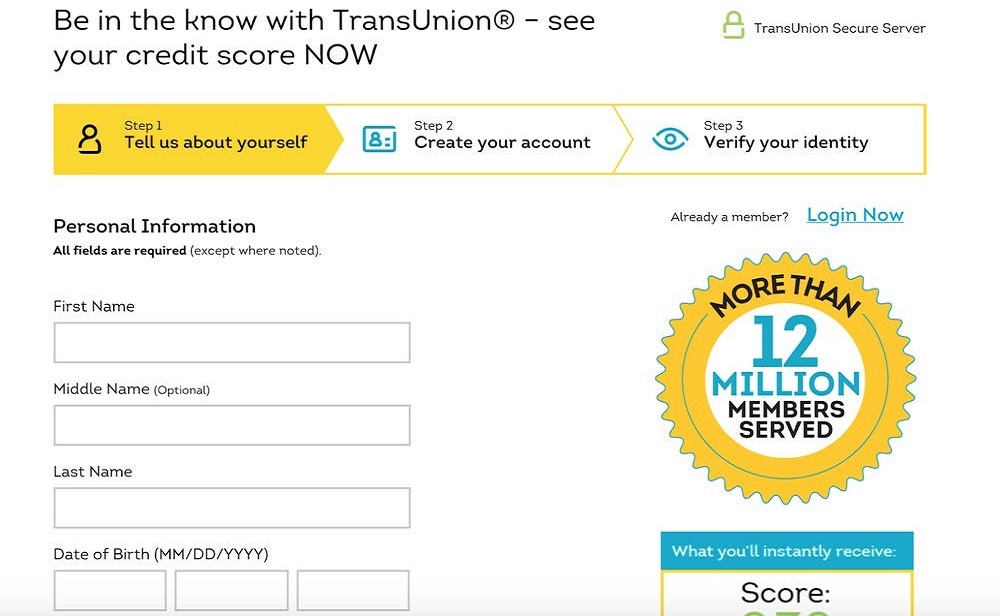

See an instance below of an identity/personal data section of the TransUnion credit report; what to expect:

Naturally, you could look past this particular section of your credit history; at the same time, you’d certainly want to be sure the data provided there is correct.

Don’t let it catch you unaware as you can notice different spellings to write your name. However, that’s normal since several businesses get it wrong during a customer’s registration or the preparative session.

Besides, you’d observe short forms of your full name or pet names filled in the blank during registration, including the original surname of a married woman and matrimonial surnames.

If you are suspicious of any street addresses or feel skeptical about them, kindly think twice and keep your eyes open; this can be a scam attempt.

Account data

After the personal information is the “Account data part,” referred to as “Tradelines.” Tradelines tell the precise number of accounts a customer already signed up for and deactivate likewise. The user’s Account data is another basic feature in the guide reading credit report.

We’d use the TransUnion report as a case study. See how it appears on a TransUnion report, comprised of the “Evaluation scale,” to indicate on the scale performance whether you made payment to the accounts at the right time, late, or not.

After that, the reports has accounts drafted separately, displaying the following information;

Various account categories, the date created, lines of credit, banking records, and Balances from top to bottom.

Account information for Transunion

We’d analyze that with TransUnion for you to understand properly.

The above image shows an HD print of an American Express account with the precise account number.

After that, TransUnion displays the information for the account as shown below:

- The date created

- Account use (for example, personal or group-owned account)

- The Account categories (for instance; revolving Accounts)

- Loan samples (such as credit cards)

- Update on payment of bills (for instance, current, overdue for a month-long late, etc.)

- Stipulation (like. paid once a month)

Transunion Credit history

Check out this summary as follows to have an idea.

A credit history presents complete data of your banking record for each account, down to the time you register each account.

With the previous description, you know how the account appears, including the items displayed using a TransUnion record—for each month, the report presents any owed money.

Also, the money you’re yet to pay, likewise the customer’s promptness to bill payments. And if you make payment without delay or contrary (that is behind schedule).

Note: That’s most likely the main part of all your credit reports sections to keep your eyes open and investigate for a scam.

If it happens, you notice any accounts on your credit report, and it’s without your consent for signing it up, you had better indicate and point it out. It’s good as that.

We suggest you type out your credit history, then call attention to any problems you have in mind to dispute.

Guide Reading credit report: Credit pulls (soft versus hard)

After the above section, there are pulls on your credit report. These are primarily when a creditor or different agencies want to inquire into a user’s credit.

A Guide reading credit report is incomplete without Credit pulls.

Hard pulls

To give an instance, assume you requested another credit card lately. Nice, the credit company, goes through a customer’s credit report and checks it thoroughly.

Then get to know the class of borrowers you belong to also your habit of borrowing money so they can decide your eligibility to borrow.

The above illustration is a hard pull.

Using Experian’s report as a case study, this is how things appear here. In the case of Experian, it discloses the creditor’s name when the pull happens. And, the day it should drop from the credit report as slated.

Please take note of any hard pulls since it thus impacts a credit score and contributes negative item and seeks your consent to agree. Thus, if you notice a hard pull on the credit report that looks skeptical or without your consent, point out such until the time you want to dispute.

Soft pulls

Moreover, we’d like to identify that Experian will put on display “soft pulls” on a credit report also, something as follows:

Soft pulls comprise information such as the time a company carries out an identity verification for you or the time you demand another sample of your credit report. That’s what it’s in presented from the screen capture above. You can see the time I make demands for a duplicate of a credit report by Experian; the info appears as soft pulls on the Experian report.

Please read about the basic things you should be conversant with soft pulls: these pulls do not hurt or affect your credit score. Thus you can’t disputed. You don’t have to worry about them.

Study the checklist below that tells the difference between soft vs. hard pulls:

Hard pulls

- It contributes to a negative information

- Hard pulls reduce a credit score (1-5 points)

- It happens while a creditor checks into the credit details

- Seeks your indulgence

Soft pulls

- The pulls do not contribute to negative information

- It does not reduce credit score

- Appears as included in an identity verification

- It does not seek your indulgence

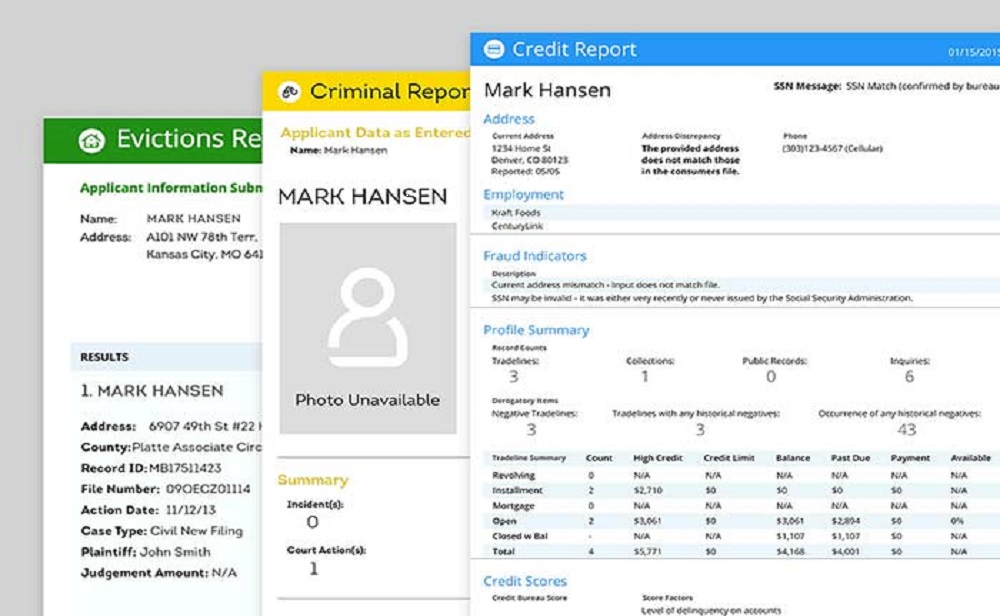

Guide reading credit report: Public records & collections

The last two parts of a credit report may incorporate collections or public records. In some cases, it has both featured together.

So, for a better understanding of the Guide reading credit report, you should get the idea of collections and public records.

Public records

You can only see a sample of public record on a credit report: that’s bankruptcy. This item could remain on a credit report for up to 7-10 years’ subject to if put in an official request for Chapter 13 or Chapter 7 bankruptcy.

Collections

For collections, the part itemizes any accounts still in debt. When you couldn’t repay a credit or loan, the lender could decide to hand it to a collector.

Collections can considerably lower a credit rating. In fact, it’s complex to delete from your credit history. Find out more to delete collections.

Good, now that your credit reports are at your fingertips, you can check the report in detail and understand the information there. Also, with other data on a credit report. Thanks to the Guide reading credit report.

At this point, get started and dispute any inaccuracies found in the report.